New Delhi, March 22 (IANS) – Foreign liquidity is drying up in small and mid-cap space, potentially affecting price momentum, according to Elara Securities. The brokerage firm emphasized the need to monitor domestic liquidity trends closely to gauge future developments.

In the current year, India experienced robust liquidity from both foreign and domestic investors, leading to heightened activity in the small and mid-cap segments. However, recent data suggests a slowdown in India-bound funds, with total inflows of $144mn (across large, mid, and small caps) marking the slowest pace since May 2023. This decline is attributed to significant outflows from Luxemburg-based funds and reduced inflows from US and Japan-based funds.

India-dedicated long-only funds witnessed their first redemption of $184mn in the past year, with mid-cap funds showing a gradual increase in outflows since January 2024. Notably, the report highlights that the resilience of India flows is primarily evident in ETF investments.

Historically, India-dedicated mid-cap funds experienced substantial inflows during the periods of 2014-2015 and 2017-2018. Conversely, during the redemption cycles of 2016 and 2018-2020, mid-cap stocks faced challenges as domestic liquidity diminished post-demonetization.

As the trends in foreign and domestic liquidity continue to evolve, market participants are urged to stay vigilant and adapt to the changing investment landscape to mitigate risks and capitalize on emerging opportunities.

Euan Blair Net Worth 2024: How Much is Tony Blair’s Son Worth?

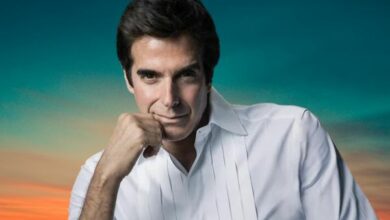

Euan Blair Net Worth 2024: How Much is Tony Blair’s Son Worth? David Copperfield Net Worth 2024: How Much is the Novel by Charles Dickens Worth?

David Copperfield Net Worth 2024: How Much is the Novel by Charles Dickens Worth? Noel Biderman Net Worth 2024: How Much is the Canadian Internet entrepreneur and business professional Worth?

Noel Biderman Net Worth 2024: How Much is the Canadian Internet entrepreneur and business professional Worth? Adam Selipsky Net Worth 2024: How Much is the CEO of Amazon Web Services, Inc. Worth?

Adam Selipsky Net Worth 2024: How Much is the CEO of Amazon Web Services, Inc. Worth? Ken Langone Net Worth 2024: How Much is the American Businessman Worth?

Ken Langone Net Worth 2024: How Much is the American Businessman Worth? Anthony Geisler, Xponential Fitness Founder and CEO Suspended “Indefinitely” Amid Fraud Allegations

Anthony Geisler, Xponential Fitness Founder and CEO Suspended “Indefinitely” Amid Fraud Allegations Navigating Forex Brokers: Choosing the Right Partner for Your Trading Journey

Navigating Forex Brokers: Choosing the Right Partner for Your Trading Journey Navigating the Complexities of MT4: A Comprehensive Guide for Beginners

Navigating the Complexities of MT4: A Comprehensive Guide for Beginners