Finance

Does FDCPA apply to business debts?

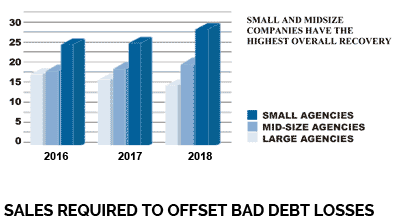

Numerous commercial debt companies take it upon themselves to track down businesses that fail to pay their amount at the specified time.

Many enterprises and third-party businesses tend to collect debts on behalf of a different entity or person. The Fair Debt Collection Practices Act or the FDCPA limits the behavior of outsourced debt collectors. As amended in 2010, the US law restricts the number of times a collector can contact the debtor in one day. In case the FDCPA policy is violated, the debt collection company and individual debt collector can be sued for any damages caused.

How Does the FDCPA work?

The FDCPA does not work for private debtors. For example, if you owe money to the local mechanics’ store, and the owner calls you to collect their amount in due time, that person is not a debt collector by law. The Fair Debt Collection policies only apply to third party collectors, such as agents that work for debt collecting companies. Student loans, credit card bills, mortgages, household are some of the obligations covered by the act.

The Business Debt Agencies

When a business gets stuck with outstanding debt past its due, the initial creditor will try to obtain the amount before sending it for collection. If the same company cannot pay within the 90-120 day time period set by the FDCPA, the creditor has three options: sell the debt to a commercial debt collection agency, sue the company, or assign.

The latter means that the original creditor may include a third party to collect the money on behalf of them, or it can also mean that they have the right to manage and keep the cash if deemed legal.

Numerous commercial debt companies take it upon themselves to track down businesses that fail to pay their amount at the specified time. The organization will attempt to contact the debtor via email or phone, and if they do not get a response, they are most likely to file a lawsuit.

According to the data, a small amount of debt can negatively affect a business. However, the pressure of having to pay back in time during an unprofitable period can be quite tough to handle. The Fair Debt Collection Parties Act protects those businesses with outstanding debt by prohibiting loan collectors from contacting them repeatedly.

However, the FDCPA is not legally relevant to commercial companies where the agents are not subjected to regulation. The Commercial Collection Agency Association or the CCAA abides by high money collection standards, upholding strong ethics. To become an official member of the group, you need to get a license by submitting an application and submitting a bond. Once you obtain the permit, it needs to get renewed every year to ensure its applicability.

The FDCPA Regulations

Since the FDCPA law does not apply to commercial businesses, the collection practices might become more straightforward for the creditors. But like more things in life, it takes more than just a little explanation to register the details of commercial debt accumulation. To help you better understand the financial act’s central policies, let’s work our way through each directive level to come up with a fully understood response.

Federal rules over business debts

The FDCPA might not apply to third parties, but the legislation clearly states that it works on a household, family, and personal debts. This means that the act excludes all the money incurred on behalf of a business organization. No such federal law exists as yet that would apply to third-party efforts on collecting business loans.

State laws on collecting business debts

It depends on your location or region and if the state government has worked on commercial debt collection policies through the law. Many cities have passed the regulation that involves third-party collection agencies to get licensed by the state directly. There is a high chance that the government might need an agency to be bonded simultaneously.

The pre-requisites above might not offer full consumer protection, the same level as the FDCPA, but they do provide considerable entry barriers to the holistic collection realm. That stops many random profit-seekers from setting up collection businesses on a whim.

The reputation is important

Following the amendment by the FDCPA on commercial debt collection is not optional. While people might take their time understanding that, it is essential to note that going above and beyond those regulations to make sure the treatment of customers is done with respect is the best way to conduct a loan collection.

Many debt collection associations judge, rate, and review collection companies on how they plan their work. Still, only the positively renowned organisations will get the chance to work with reputable businesses. Keeping that in mind, a collection agency needs to follow all the rules set by the FDCPA whether or not they apply to the specific loan they are working on. Not only is it the right thing to do, but it also lies in the best interest of long-term business relationships.

Holistically Speaking

The type of debt collection varies from business to business. In the end, all that matters is making a deal for a suitable takeaway from clients, working through a reputable agency, and placing your image on the map. This saves you the time, stress, and aggravation involved in the money collection process.

Make it a point to form a rapport with an excellent commercial debt collection agency so you can keep your focus on significant things, like making people’s lives a bit easier.

India News

Fake Videos of NSE CEO Ashish Chauhan Recommending Stocks in Circulation, NSE Issues Caution

Nowadays, the proliferation of fake videos on stock market operations is increasing and getting viral. In the wake of this, the NSE and the National Stock Exchange have issued certain guidelines on these, reported Livemint.

NSE has extended a stern caution to those investors who make fake videos purportedly recommending stocks by showcasing Shri Ashishkumar Chauhan.

Notably, Shri Ashishkumar Chauhan is the Managing Director and Chief Executive Officer of NSE. NSE said, “NSE in a few investment and advisory audio and video clips falsely created using technology.

Such videos seem to have been created using sophisticated technologies to imitate the voice and facial expressions of Shri Ashishkumar Chauhan, MD & CEO of NSE.”

As per TimesNow, the national stock exchange has also requested investors to verify information, exercise vigilance and only trust what appears on official NSE channels.

Information can also be verified from www.nseindia.com, the official website. Other official social media handles include, “Twitter: @NSEIndia, Facebook: @NSE India, Instagram: @nseindia, LinkedIn: @NSE India, and YouTube: NSE India.”

Ashishkumar Chauhan, the MD and CEO wrote on X, “Caution – clarification on fake audio/ videos of NSE MD and CEO recommending specific stocks – circulating on social media for last few days.”

This statement is the follow-up of the surfacing of the manipulated video and audio clips regarding stock recommendations.

These fake videos make use of advanced and sophisticated technology which mimic the MD’s voice and facial expressions. Thus, this creates an alarming and misleading situation for unsuspecting investors.

NSE Employees Cannot Recommend Stocks

Thus, investors are advised not to fall for such fraudulent content and take investment decisions. NSE also clarified that its employees are “not authorized” to recommend or endorse any specific stocks.

NSE has also asked online platforms to take back potential deceptive videos. Meanwhile, the public and investors are requested to verify the authenticity of information and exercise caution before taking any wrong step which may cause financial loss and personal harm.

Lifestyle

Navigating the Loan Landscape: Your Guide to Loans in Canada

The notion of taking out a loan can be quite daunting, especially with various financial products available. Borrowing money is a significant decision, and it’s crucial to understand not only the types of loans out there but also the implications for your financial health. This comprehensive guide will walk you through the loan landscape of Canada, detailing the different types of loans, their uses, and what to consider before taking one out.

Understanding the Different Types of Loans

Lending institutions in Canada offer a multitude of loan options tailored to meet the diverse financial needs of individuals. Understanding the differences between these loans is the first step in making an informed borrowing decision.

Personal Loans

Personal loans are among the most versatile financial tools available. They come in two main varieties—secured and unsecured. A secured personal loan requires the borrower to pledge an asset as collateral, which can be seized by the lender if the borrower defaults. On the other hand, unsecured personal loans do not require collateral, instead, they are approved based on the borrower’s creditworthiness.

Uses: Personal loans can be used for various purposes, including consolidating debt, making home improvements, and funding large purchases.

Mortgage Loans

A mortgage is a loan specifically used to purchase real estate. It’s a long-term loan that can be repaid over a period of 15 to 30 years. Mortgages require the property being purchased as collateral.

Uses: Most commonly used to buy a home or investment property.

Car Loans

Also known as auto loans, these are used to finance a car purchase. The car being financed serves as collateral for the loan.

Uses: Specifically for purchasing new or used vehicles.

Student Loans

Student loans are specifically designed to help students cover the cost of higher education. They come with lower interest rates and more flexible terms than many other loan types.

Uses: To cover tuition fees, books, accommodation, and other educational expenses.

Business Loans

Business loans are taken out by entrepreneurs for commercial or operational purposes related to their business.

Uses: Funding new ventures, purchasing equipment, or covering working capital needs.

How to Choose the Right Loan for Your Needs

Selecting the right loan is crucial for successful borrowing. Here are several factors to take into account:

Determine Your Purpose

Different loans serve different purposes. Determine the specific reason for your loan before proceeding. Whether it’s securing a hard asset like a home or car, consolidating debt, or investing in your education or business, the purpose will point you toward the most suitable loan type.

Interest Rate

The interest you pay on your loan is a significant cost of borrowing. Shop around to find the best interest rates, and remember that they can be variable or fixed.

Loan Term

This is the duration within which you agree to pay off the loan. A longer loan term may have lower monthly payments, but you’ll pay more interest over time. A shorter term can save you money on interest but means higher monthly payments.

Fees and Charges

Loans often come with additional costs, such as origination fees, prepayment penalties, and late payment fees. Be sure to factor these into your loan decision.

Repayment Flexibility

Some loans offer more flexibility in how and when you repay them. For example, personal lines of credit may have open-ended terms, while student loans may offer grace periods.

Effect on Credit Score

Taking out a loan can impact your credit score, both positively and negatively, depending on how you manage the debt. Consider how the loan will affect your credit when choosing a loan type.

The Loan Application Process in Canada

Each loan type has its own application process, but most follow a standard set of steps.

Preparing Your Documents

Banks and lenders will require certain documents, including identification, proof of income, and financial statements. Having these ready can expedite the application process.

Submitting Your Application

Whether online, over the phone, or in person, you’ll need to provide information about the loan amount you’re seeking, the purpose of the loan, and your financial history.

Underwriting

The underwriting process is where the lender assesses your creditworthiness and the risk of lending to you. They’ll consider your credit score, income, debt-to-income ratio, and employment history.

Approval and Disbursement

If approved, the lender will present you with the loan terms. After you accept, the funds can be disbursed, typically through direct deposit or a check.

What to Consider When Repaying Your Loan

Repaying your loan is as important as selecting the right loan. It has implications for your financial stability and creditworthiness.

Creating a Repayment Strategy

Create a plan to manage your loan repayments. Budgeting and setting up automated payments can help you stay on track.

Consider Accelerated Repayment

Paying more than your minimum monthly requirement or making extra payments can reduce the total interest you pay over the life of the loan.

Understanding Default and Collections

If you can’t make your loan payments, you risk default. Defaulting can lead to damaged credit, wage garnishment, and the loss of collateral if the loan is secured. It’s vital to communicate with your lender if you’re experiencing financial hardship.

Impact on Credit

Successfully repaying a loan can improve your credit score, making it easier to borrow in the future. Conversely, defaulting on a loan can have long-lasting negative effects on your credit.

Loans and Your Financial Future

Taking out a loan can be a significant step in your financial life. It can help you achieve your goals, but it also comes with responsibilities. Here’s how loans relate to your financial future in Canada.

Building Credit

Responsible borrowing and payment of loans can steadily improve your credit score, which is essential for future borrowing needs such as mortgages, car loans, and credit cards.

Savings and Investments

Loans can help you make large purchases or investments that you might not be able to afford upfront. Be sure to consider the return on investment and the cost of borrowing when making these decisions.

Emergency Preparedness

An emergency fund can reduce the need to take out loans in unexpected situations. Having cash reserves can provide peace of mind and reduce the overall debt burden.

Retirement Planning

High-interest debt can derail your retirement savings. Understanding your loan terms and prioritizing debt repayment can free up more money to invest in your retirement accounts.

In conclusion, navigating the loan landscape in Canada requires careful consideration of the multitude of options available and the implications they hold for your financial health. By understanding the types of loans, selecting the right one for your needs, managing the application process, and planning for repayment, you can make informed decisions that support your financial goals. Remember, borrowing is a tool to be used wisely, not a solution in itself. Make sure to consult with financial professionals when necessary and always be mindful of your long-term financial well-being.

World

US Visa Fee Hike And Its Impact For Families, Employers, Investor Applicants

In a new development which will have far reaching implications for Indians, the U.S. has hiked Visa fees by a huge margin and it will come into effect from April. The visa fees hike will impact everyone from those who seek employment in the US like IT professionals, employers, sponsors, US citizens who seek to bring their relatives to the US and also high profile investors who want to do business in the US. The move has evoked sharp criticism by experts who have contended that there is a paucity of resources needed to address the increasing humanitarian workload and efforts to reduce backlogs.

The changes in the visa fees is as follows-

- 70% hike for H-1B visa petitions being sponsored by employers. Also the H-1B electronic registration fee will rise from $10 to $215.

- L-1 visa fees hiked by 201% and O-1 visa hiked by 129%,

- The initial EB-5 investment-linked green card visa fee has been hiked by $3,675 (over Rs 3, 00,000) to $11,160 (over Rs 9, 00,000)

- Provision of a new Asylum Program fee of $600 which will be applicable for specific worker and immigrant petition

The visa fees hike for H1-B, L-1, and EB-5 categories will affect the Indians most because these three visas are the most common which is applied by Indians. This has been the most significant hike since 2016 and the hike as per US Citizenship and Immigration Services (USCIS) , which comes under the Department of Homeland Security (DHS), will help recover the costs and help in speedy increase processing of applications.

Fallout On Families And Spouses

The I-130 form fees have been hiked by 26% to $675 and it will impact those families which seek reunification including marriage which will enable spouses to migrate to the US. If a green card holder applies for an I-130 visa seeking to enable a relationship with an eligible relative who seeks to permanently settle in the US and seek a green card the fee stands at $1,440 as compared to earlier $1,225. Also if the person seeks to bring his fiancée to the US via Form I-129F, the fee has been hiked from $535 to $675, an increase of 26%.

Even if the couple goes for an out of country marriage the petitioner would need to file Form I-130 for their spouse to immigrate. The Form I-130 carries fees of $675; therefore, out-of-country marriage would not result in significant cost savings.

Also the process of applying for American Citizenship has also become very expensive but the fees for the online application for naturalization with biometric services has seen a decline from $725 to $710.

The most notable increase is seen in the EB-5 – the investment-linked green card visa program has been hiked almost three times from $3,675 (over Rs 300,000) to $11,160 (over Rs 900,000) for their initial I-829 application. This increase will significantly impact the wealthy Indians who seek to invest in the US for residency purposes.

The EB-5 program will require the applicant to go through a consulate interview. They must also possess a conditional green card valid for two years and for a permanent green card, the applicant will have to go through an application process. The EB-5 program came into existence in 1990 and was aimed to bring in high value foreign investments and applicants will have to invest a minimum of $5,00,000 in a US business and get a visa to stay in the US.

Fallout On IT Professionals

This is a hike which will affect most of the Indians who seek a job in the IT sector in the US. H-1B visa was originally meant to suck in highly qualified Professionals in India who had passed out from premium Institutes such as IIT or IIM. It was a big source to attract highly trained professionals which will serve to dill in the requirements of the IT sector. Thousands of highly trained professionals apply for HI visas for better employment opportunities in the US. The H-1B visa has been increased from $460 (over Rs 38,000) to $780 (over Rs 64,000), with the registration fee also increasing from $10 (Rs 829) to $215 (over Rs 17,000) – an increase of 2,000%.

USCIS has contended that the increased fees will boost revenue and help improve customer experience and backlog.

USCIS director Ur M Jaddou said “It is for the first time in over seven years, USCIS is updating our fees to better meet the needs of our agency, enabling us to provide more timely decisions to those we serve”.

The hike in Visa fees has been severely criticized by many experts. One of the main critics has been the IT sector and the music industry which is dependent on overseas employees and the latest visa hike will affect this sector the most.

Also Read: Who Is Savion Johnson? Texas National Guard Member Arrested For Migrant Smuggling

Photos20 hours ago

Photos20 hours ago65+ Georgina Rodriguez Hot, Sexy, Naked Pics: Top Bikini Photos of Cristiano Ronaldo’s Girlfriend

Photos1 week ago

Photos1 week ago40+ Sassy Poonam Hot and Sexy Photos: Top Bikini Pics

Entertainment1 week ago

Entertainment1 week ago9 Kamalika Chanda Web Series List (18+ Only)

Photos7 days ago

Photos7 days agoShraddha Arya Hot and Sexy Pics: 20 Times Kundali Bhagya Actress Flaunted Her Sexy Curves in Raunchy Swimsuits

Viral1 week ago

Viral1 week agoShanin Blake’s OnlyFans Leak Leads To Concern Over Social Media Privacy

Entertainment5 days ago

Entertainment5 days ago8 Sapna Sharma Hot Web Series for 2024 (18+ Only)

Web Series19 hours ago

Web Series19 hours ago15 Hot Sharanya Jit Kaur web series to binge-watch online

Entertainment1 week ago

Entertainment1 week ago(18+ Only) Zoya Rathore Web Series List for 2024