window._wpemojiSettings = {"baseUrl":"https:\/\/s.w.org\/images\/core\/emoji\/15.0.3\/72x72\/","ext":".png","svgUrl":"https:\/\/s.w.org\/images\/core\/emoji\/15.0.3\/svg\/","svgExt":".svg","source":{"concatemoji":"https:\/\/www.uniquenewsonline.com\/wp-includes\/js\/wp-emoji-release.min.js?ver=6.5.2"}};

/*! This file is auto-generated */

!function(i,n){var o,s,e;function c(e){try{var t={supportTests:e,timestamp:(new Date).valueOf()};sessionStorage.setItem(o,JSON.stringify(t))}catch(e){}}function p(e,t,n){e.clearRect(0,0,e.canvas.width,e.canvas.height),e.fillText(t,0,0);var t=new Uint32Array(e.getImageData(0,0,e.canvas.width,e.canvas.height).data),r=(e.clearRect(0,0,e.canvas.width,e.canvas.height),e.fillText(n,0,0),new Uint32Array(e.getImageData(0,0,e.canvas.width,e.canvas.height).data));return t.every(function(e,t){return e===r[t]})}function u(e,t,n){switch(t){case"flag":return n(e,"\ud83c\udff3\ufe0f\u200d\u26a7\ufe0f","\ud83c\udff3\ufe0f\u200b\u26a7\ufe0f")?!1:!n(e,"\ud83c\uddfa\ud83c\uddf3","\ud83c\uddfa\u200b\ud83c\uddf3")&&!n(e,"\ud83c\udff4\udb40\udc67\udb40\udc62\udb40\udc65\udb40\udc6e\udb40\udc67\udb40\udc7f","\ud83c\udff4\u200b\udb40\udc67\u200b\udb40\udc62\u200b\udb40\udc65\u200b\udb40\udc6e\u200b\udb40\udc67\u200b\udb40\udc7f");case"emoji":return!n(e,"\ud83d\udc26\u200d\u2b1b","\ud83d\udc26\u200b\u2b1b")}return!1}function f(e,t,n){var r="undefined"!=typeof WorkerGlobalScope&&self instanceof WorkerGlobalScope?new OffscreenCanvas(300,150):i.createElement("canvas"),a=r.getContext("2d",{willReadFrequently:!0}),o=(a.textBaseline="top",a.font="600 32px Arial",{});return e.forEach(function(e){o[e]=t(a,e,n)}),o}function t(e){var t=i.createElement("script");t.src=e,t.defer=!0,i.head.appendChild(t)}"undefined"!=typeof Promise&&(o="wpEmojiSettingsSupports",s=["flag","emoji"],n.supports={everything:!0,everythingExceptFlag:!0},e=new Promise(function(e){i.addEventListener("DOMContentLoaded",e,{once:!0})}),new Promise(function(t){var n=function(){try{var e=JSON.parse(sessionStorage.getItem(o));if("object"==typeof e&&"number"==typeof e.timestamp&&(new Date).valueOf()<e.timestamp+604800&&"object"==typeof e.supportTests)return e.supportTests}catch(e){}return null}();if(!n){if("undefined"!=typeof Worker&&"undefined"!=typeof OffscreenCanvas&&"undefined"!=typeof URL&&URL.createObjectURL&&"undefined"!=typeof Blob)try{var e="postMessage("+f.toString()+"("+[JSON.stringify(s),u.toString(),p.toString()].join(",")+"));",r=new Blob([e],{type:"text/javascript"}),a=new Worker(URL.createObjectURL(r),{name:"wpTestEmojiSupports"});return void(a.onmessage=function(e){c(n=e.data),a.terminate(),t(n)})}catch(e){}c(n=f(s,u,p))}t(n)}).then(function(e){for(var t in e)n.supports[t]=e[t],n.supports.everything=n.supports.everything&&n.supports[t],"flag"!==t&&(n.supports.everythingExceptFlag=n.supports.everythingExceptFlag&&n.supports[t]);n.supports.everythingExceptFlag=n.supports.everythingExceptFlag&&!n.supports.flag,n.DOMReady=!1,n.readyCallback=function(){n.DOMReady=!0}}).then(function(){return e}).then(function(){var e;n.supports.everything||(n.readyCallback(),(e=n.source||{}).concatemoji?t(e.concatemoji):e.wpemoji&&e.twemoji&&(t(e.twemoji),t(e.wpemoji)))}))}((window,document),window._wpemojiSettings);

https://www.uniquenewsonline.com/wp-includes/js/jquery/jquery.min.js

https://www.uniquenewsonline.com/wp-includes/js/jquery/jquery-migrate.min.js

var pbLocalizeObj = {"ajax":"https:\/\/www.uniquenewsonline.com\/wp-admin\/admin-ajax.php","seconds":"seconds","thisWillClose":"This will close in","icons":{"close_icon":"<svg class=\"ays_pb_material_close_icon\" xmlns=\"https:\/\/www.w3.org\/2000\/svg\" height=\"36px\" viewBox=\"0 0 24 24\" width=\"36px\" fill=\"#000000\" alt=\"Pop-up Close\"><path d=\"M0 0h24v24H0z\" fill=\"none\"\/><path d=\"M19 6.41L17.59 5 12 10.59 6.41 5 5 6.41 10.59 12 5 17.59 6.41 19 12 13.41 17.59 19 19 17.59 13.41 12z\"\/><\/svg>","close_circle_icon":"<svg class=\"ays_pb_material_close_circle_icon\" xmlns=\"https:\/\/www.w3.org\/2000\/svg\" height=\"24\" viewBox=\"0 0 24 24\" width=\"36\" alt=\"Pop-up Close\"><path d=\"M0 0h24v24H0z\" fill=\"none\"\/><path d=\"M12 2C6.47 2 2 6.47 2 12s4.47 10 10 10 10-4.47 10-10S17.53 2 12 2zm5 13.59L15.59 17 12 13.41 8.41 17 7 15.59 10.59 12 7 8.41 8.41 7 12 10.59 15.59 7 17 8.41 13.41 12 17 15.59z\"\/><\/svg>","volume_up_icon":"<svg class=\"ays_pb_fa_volume\" xmlns=\"https:\/\/www.w3.org\/2000\/svg\" height=\"24\" viewBox=\"0 0 24 24\" width=\"36\"><path d=\"M0 0h24v24H0z\" fill=\"none\"\/><path d=\"M3 9v6h4l5 5V4L7 9H3zm13.5 3c0-1.77-1.02-3.29-2.5-4.03v8.05c1.48-.73 2.5-2.25 2.5-4.02zM14 3.23v2.06c2.89.86 5 3.54 5 6.71s-2.11 5.85-5 6.71v2.06c4.01-.91 7-4.49 7-8.77s-2.99-7.86-7-8.77z\"\/><\/svg>","volume_mute_icon":"<svg xmlns=\"https:\/\/www.w3.org\/2000\/svg\" height=\"24\" viewBox=\"0 0 24 24\" width=\"24\"><path d=\"M0 0h24v24H0z\" fill=\"none\"\/><path d=\"M7 9v6h4l5 5V4l-5 5H7z\"\/><\/svg>"}};

https://www.uniquenewsonline.com/wp-content/plugins/ays-popup-box/public/js/ays-pb-public.js

var breeze_prefetch = {"local_url":"https:\/\/www.uniquenewsonline.com","ignore_remote_prefetch":"1","ignore_list":["\/wp-admin\/"]};

https://www.uniquenewsonline.com/wp-content/plugins/breeze/assets/js/js-front-end/breeze-prefetch-links.min.js

-

Career7 hours ago

Report: NEET SS 2024 May Not Be Conducted This Year Due to the Admission Delay of the 2021 Batch

An RTI or Right to Information request was submitted by Dr Vivek Pandey, an activist, regarding the advancement of the NEET PG 2024 examination. The NMC,...

-

Information10 hours ago

Understanding Your Rights: What to Do When Arrested

Being arrested can be an intimidating and confusing experience. Knowing your rights and understanding the appropriate steps to take can significantly affect the outcome of your...

-

Information10 hours ago

Finding the Right Swipe Machine Price for Your Budget

Over the years, many factors have become influential when discussing SME competition. In fact, statistics show that 62% of India’s SMBs are using online platforms to...

-

Uncategorised10 hours ago

Rummy Bo Welcome Bonus

Nothing can measure up to the pleasure of playing rummy with your most cherished friends. Then why miss it? At Rummy BO – India’s Most Loved Rummy...

-

Sports11 hours ago

Who is Johnny Manziel’s Girlfriend? Who Is The American Football Quarterback Dating?

Who is Johnny Manziel? Jonathan Paul Manziel, popularly known as Johnny Manziel, is a former American football quarterback who gained prominence during his college career at...

-

Net Worth11 hours ago

Dave Ramsey Net Worth 2024: How Much is American Radio Personality Worth?

Who is Dave Ramsey? Dave Ramsey is a prominent American radio personality, author, financial expert, and business entrepreneur renowned for his straightforward financial advice and remarkable...

-

Net Worth11 hours ago

Jason Weaver Net Worth 2024: How Much is the American Actor and Singer Worth?

Who is Jason Weaver? Jason Weaver is an American actor, singer, and voice artist, best known for his versatile contributions to film and television. Born on...

-

Net Worth11 hours ago

David Hogg Net Worth 2024: How Much is the Activist Worth?

Who is David Hogg?‘ David Hogg is a renowned American activist and advocate for gun control, gaining prominence following the tragic Marjory Stoneman Douglas High School...

-

Sports11 hours ago

Who is Xavier Worthy Girlfriend? Who Is The American Football Wide Receiver Dating?

Who is Xavier Worthy? Xavier Worthy is a standout American football wide receiver known for his exceptional talent and remarkable achievements. Born on April 27, 2003,...

-

Net Worth11 hours ago

Xavier Worthy Net Worth 2024: How Much is the American Football Wide Receiver Worth?

Who is Xavier Worthy? Xavier Worthy, an emerging sensation in American football, has carved his name into the annals of football history with his exceptional talent...

-

Net Worth11 hours ago

Daniel Wai Net Worth 2024: How Much is the Fitness Coach Worth?

Who is Daniel Wai? Daniel Wai is a prominent figure in the fitness industry, known for his innovative approaches to training and his dedication to helping...

-

Sports11 hours ago

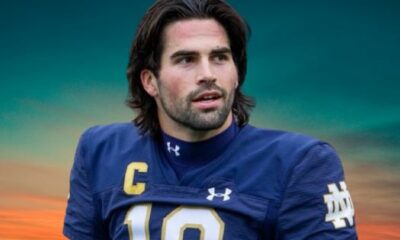

Who is Sam Hartman’s Girlfriend? Who Is The American Football Quarterback Dating?

Who is Sam Hartman? Sam Hartman, born on July 29, 1999, is an American football quarterback who has garnered attention for his exceptional performance on the...

(adsbygoogle = window.adsbygoogle || []).push({});

if (window.innerWidth < 768) { jQuery(document).find('.ays-pb-modal_2').css({'top': '0', 'right': '0', 'bottom': '0', 'left': '0'}); } else { jQuery(document).find('.ays-pb-modal_2').css({'top': '0', 'right': '0', 'bottom': '0', 'left': '0'}); }

(function( $ ) {

'use strict';

$(document).ready(function(){

let pbViewsFlag_2 = true;

if ('image_type_img_theme' == 'notification') {

$(document).find('.ays-pb-modals').prependTo($(document.body));

} else {

$(document).find('.ays-pb-modals:not(.ays-pb-modals.ays-pb-notification-modal)').appendTo($(document.body));

}

let isMobile = false;

let closePopupOverlay = 1;

let isPageScrollDisabled = 0;

let checkAnimSpeed = 1;

let ays_pb_animation_close_speed = $(document).find('#ays_pb_animation_close_speed_2').val();

let ays_pb_effectIn_2 = $(document).find('#ays_pb_modal_animate_in_2').val();

let ays_pb_effectOut_2 = $(document).find('#ays_pb_modal_animate_out_2').val();

if (window.innerWidth < 768) {

isMobile = true;

closePopupOverlay = 1;

isPageScrollDisabled = 0;

checkAnimSpeed = 1;

ays_pb_animation_close_speed = $(document).find('#ays_pb_animation_close_speed_mobile_2').val();

ays_pb_effectIn_2 = $(document).find('#ays_pb_modal_animate_in_mobile_2').val();

ays_pb_effectOut_2 = $(document).find('#ays_pb_modal_animate_out_mobile_2').val();

}

let ays_pb_delayOpen_2 = parseInt($(document).find('.ays_pb_delay_2').val());

let ays_pb_scrollTop_2 = parseInt($(document).find('.ays_pb_scroll_2').val());

if (isMobile) {

if (0) {

ays_pb_scrollTop_2= parseInt($(document).find('.ays_pb_scroll_mobile_2').val());

}if (0) {

ays_pb_delayOpen_2 = parseInt($(document).find('.ays_pb_delay_mobile_2').val());

}

}

let time_pb_2 = $(document).find('.ays_pb_timer_2 span').data('seconds'),

ays_pb_animation_close_seconds = (ays_pb_animation_close_speed / 1000);

if( ays_pb_delayOpen_2 == 0 && ays_pb_scrollTop_2 == 0){

$(document).find('.av_pop_modals_2').css('display','block');

}if (window.innerWidth < 768) {

var mobileTimer = +$(document).find('.ays_pb_timer_2 span').attr('data-ays-mobile-seconds');

$(document).find('.ays_pb_timer_2 span').html(mobileTimer);

time_pb_2 = mobileTimer;

}ays_pb_animation_close_speed = parseFloat(ays_pb_animation_close_speed) - 50;$(document).find('.ays_music_sound').css({'display':'none'});

if(time_pb_2 !== undefined){

if(time_pb_2 !== 0){

$(document).find('#ays-pb-modal-checkbox_2').trigger('click');

if(ays_pb_scrollTop_2 == 0){

var ays_pb_flag = true;

$(document).find('.ays-pb-modal_2').css({

'animation-duration': ays_pb_animation_close_seconds + 's'

});

let timer_pb_2 = setInterval(function(){

let newTime_pb_2 = time_pb_2--;

$(document).find('.ays_pb_timer_2 span').text(newTime_pb_2);

if(newTime_pb_2 <= 0){

$(document).find('.ays-pb-modal-close_2').trigger('click');

$(document).find('.ays-pb-modal_2').attr('class', 'ays-pb-modal ays-pb-modal-image-type-img ays-pb-modal_2 ays-pb-border-mobile_2 '+ays_pb_effectOut_2);

if(ays_pb_effectOut_2 != 'none'){

setTimeout(function(){

$(document).find('.ays-pb-modal_2').css('display', 'none');

$(document).find('.ays-pb-modal_2').attr('data-ays-flag','true');

}, ays_pb_animation_close_speed);

}else{

$(document).find('.ays-pb-modal_2').css('display', 'none');

$(document).find('.ays-pb-modal_2').attr('data-ays-flag','true');

}

clearInterval(timer_pb_2);

}

$(document).find('.ays-pb-modal-close_2').one('click', function(){

if (pbViewsFlag_2) {

var pb_id = 2;$.ajax({

url: pbLocalizeObj.ajax,

method: 'POST',

dataType: 'text',

data: {

id: pb_id,

action: 'ays_increment_pb_views',

},

});pbViewsFlag_2 = false;

}

$(document).find('.av_pop_modals_2').css('pointer-events', 'none');

$(document).find('.ays-pb-modal_2').attr('class', 'ays-pb-modal ays-pb-modal-image-type-img ays-pb-modal_2 ays-pb-border-mobile_2 '+ays_pb_effectOut_2);

$(this).parents('.ays-pb-modals').find('iframe').each(function(){

var key = /https:\/\/www.youtube.com/;

var src = $(this).attr('src');

$(this).attr('src', $(this).attr('src'));

});

$(this).parents('.ays-pb-modals').find('video.wp-video-shortcode').each(function(){

if(typeof $(this).get(0) != 'undefined'){

if ( ! $(this).get(0).paused ) {

$(this).get(0).pause();

}

}

});

$(this).parents('.ays-pb-modals').find('audio.wp-audio-shortcode').each(function(){

if(typeof $(this).get(0) != 'undefined'){

if ( ! $(this).get(0).paused ) {

$(this).get(0).pause();

}

}

});

var close_sound_src = $(document).find('#ays_pb_close_sound_2').attr('src');

if(checkAnimSpeed && typeof close_sound_src !== 'undefined' && 'off' === 'on'){

if(checkAnimSpeed !== 0){

var playPromise = $(document).find('#ays_pb_close_sound_2').get(0).play();

if (playPromise !== undefined) {

playPromise.then(function() {

audio.pause();

}).catch(function(error) {

});

}

}

}

if(ays_pb_effectOut_2 != 'none'){

setTimeout(function(){

$(document).find('.ays-pb-modal_2').css('display', 'none');

$(document).find('.av_pop_modals_2').css('display', 'none');

$(document).find('.ays-pb-modal_2').attr('data-ays-flag','true');

if($('#ays_pb_close_sound_2').get(0) != undefined){

if(!$('#ays_pb_close_sound_2').get(0).paused){

$(document).find('.ays-pb-modal_2').css('display', 'none');

var audio = $('#ays_pb_close_sound_2').get(0);

audio.pause();

audio.currentTime = 0;

}

}

}, ays_pb_animation_close_speed);

}else{

$(document).find('.ays-pb-modal_2').css('display', 'none');

$(document).find('.av_pop_modals_2').css('display', 'none');

$(document).find('.ays-pb-modal_2').attr('data-ays-flag','true');

if($('#ays_pb_close_sound_2').get(0) != undefined){

if(!$('#ays_pb_close_sound_2').get(0).paused){

$(document).find('.ays-pb-modal_2').css('display', 'none');

var audio = $('#ays_pb_close_sound_2').get(0);

audio.pause();

audio.currentTime = 0;

}

}

}

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0', 'display': 'none'});

clearInterval(timer_pb_2);

});

$(document).on('keydown', function(event) {

if('1' && ays_pb_flag){

var escClosingPopups = $(document).find('.ays-pb-close-popup-with-esc:visible');

if (event.keyCode == 27) {

var topmostPopup = escClosingPopups.last();

topmostPopup.find('.ays-pb-modal-close_2').trigger('click');

}

} else {

ays_pb_flag = true;

}

ays_pb_flag = false;

});

},1000);

if(closePopupOverlay && 'On' == 'On'){

$(document).find('.av_pop_modals_2').on('click', function(e) {

var pb_parent = $(this);

var pb_div = $(this).find('.ays-pb-modal_2');

if (!pb_div.is(e.target) && pb_div.has(e.target).length === 0){

$(document).find('.ays-pb-modal-close_2').click();

}

});

}

}

} else {

$(document).find('.ays_pb_timer_2').css('display','none');

$(document).find('.ays-pb-modal_2').css({

'animation-duration': ays_pb_animation_close_seconds + 's'

});

$(document).find('.ays-pb-modal-close_2').one('click', function(){

if (pbViewsFlag_2) {

var pb_id = 2;$.ajax({

url: pbLocalizeObj.ajax,

method: 'POST',

dataType: 'text',

data: {

id: pb_id,

action: 'ays_increment_pb_views',

},

});pbViewsFlag_2 = false;

}

$(document).find('.av_pop_modals_2').css('pointer-events', 'none');

$(document).find('.ays-pb-modal_2').attr('class', 'ays-pb-modal ays-pb-modal-image-type-img ays-pb-modal_2 ays-pb-border-mobile_2 '+ays_pb_effectOut_2);

$(this).parents('.ays-pb-modals').find('iframe').each(function(){

var key = /https:\/\/www.youtube.com/;

var src = $(this).attr('src');

$(this).attr('src', $(this).attr('src'));

});

$(this).parents('.ays-pb-modals').find('video.wp-video-shortcode').each(function(){

if(typeof $(this).get(0) != 'undefined'){

if ( ! $(this).get(0).paused ) {

$(this).get(0).pause();

}

}

});

$(this).parents('.ays-pb-modals').find('audio.wp-audio-shortcode').each(function(){

if(typeof $(this).get(0) != 'undefined'){

if ( ! $(this).get(0).paused ) {

$(this).get(0).pause();

}

}

});

if(ays_pb_effectOut_2 != 'none'){

setTimeout(function(){

$(document).find('.ays-pb-modal_2').css('display', 'none');

$(document).find('.av_pop_modals_2').css('display', 'none');

$(document).find('.ays-pb-modal_2').attr('data-ays-flag','true');

if($('#ays_pb_close_sound_2').get(0) != undefined){

if(!$('#ays_pb_close_sound_2').get(0).paused){

$(document).find('.ays-pb-modal_2').css('display', 'none');

var audio = $('#ays_pb_close_sound_2').get(0);

audio.pause();

audio.currentTime = 0;

}

}

}, ays_pb_animation_close_speed);

}else{

$(document).find('.ays-pb-modal_2').css('display', 'none');

$(document).find('.av_pop_modals_2').css('display', 'none');

$(document).find('.ays-pb-modal_2').attr('data-ays-flag','true');

if($('#ays_pb_close_sound_2').get(0) != undefined){

if(!$('#ays_pb_close_sound_2').get(0).paused){

$(document).find('.ays-pb-modal_2').css('display', 'none');

var audio = $('#ays_pb_close_sound_2').get(0);

audio.pause();

audio.currentTime = 0;

}

}

}

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0', 'display': 'none'});

});

}

}

let count = 0;

if( ays_pb_scrollTop_2 !== 0 ){

$(window).scroll(function() {

if(($(this).scrollTop() >= ays_pb_scrollTop_2) && (count === 0)) {

count++;

if( ays_pb_delayOpen_2 !== 0 ){

$(document).find('.ays-pb-modal_2').css('animation-delay', ays_pb_delayOpen_2/1000);

setTimeout(function(){

$(document).find('.av_pop_modals_2').css('display','block');

$(document).find('.ays-pb-modal_2').addClass(ays_pb_effectIn_2);

$(document).find('.ays-pb-modal_2').css('display', 'block');

if (window.innerWidth < 768 && $(document).find('#ays-pb-screen-shade_2').attr('data-mobile-overlay') == 'true') {

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0.5'});

}

else{

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0.500000'});

}$(document).find('.ays-pb-modal-check_2').prop('checked', true);

}, ays_pb_delayOpen_2);

}else{

$(document).find('.av_pop_modals_2').css('display','block');

$(document).find('.ays-pb-modal_2').addClass(ays_pb_effectIn_2);

$(document).find('.ays-pb-modal_2').css('display', 'block');

if (window.innerWidth < 768 && $(document).find('#ays-pb-screen-shade_2').attr('data-mobile-overlay') == 'true') {

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0.5'});

}

else{

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0.500000'});

}$(document).find('.ays-pb-modal-check_2').prop('checked', true);

}

if('false' == 'true' && window.innerWidth < 768){

if(0 != 0 && 'off' != 'on'){

let close_button_delay_for_mobile = 0;

if (ays_pb_delayOpen_2 != 0) {

close_button_delay_for_mobile += Math.floor(ays_pb_delayOpen_2);

}

$(document).find('.ays-pb-modal-close_2').css({'display': 'none'});

setTimeout(function(){

$(document).find('.ays-pb-modal-close_2').css({'display': 'block'});

}, close_button_delay_for_mobile );

}

}

else {

if(0 != 0 && 'off' != 'on'){

let close_button_delay = 0;

if (ays_pb_delayOpen_2 != 0) {

close_button_delay += Math.floor(ays_pb_delayOpen_2);

}

$(document).find('.ays-pb-modal-close_2').css({'display': 'none'});

setTimeout(function(){

$(document).find('.ays-pb-modal-close_2').css({'display': 'block'});

}, close_button_delay );

}

}

if(5 != 0){

$(document).find('.ays-pb-modal_2').css({

'animation-duration': ays_pb_animation_close_seconds + 's'

});

let timer_pb_2 = setInterval(function(){

let newTime_pb_2 = time_pb_2--;

$(document).find('.ays_pb_timer_2 span').text(newTime_pb_2);

if(newTime_pb_2 <= 0){

$(document).find('.ays-pb-modal-close_2').trigger('click');

$(document).find('.ays-pb-modal_2').attr('class', 'ays-pb-modal ays-pb-modal-image-type-img ays-pb-modal_2 '+ays_pb_effectOut_2);

if(ays_pb_effectOut_2 != 'none'){

setTimeout(function(){

$(document).find('.ays-pb-modal_2').css('display', 'none');

$(document).find('.ays-pb-modal_2').attr('data-ays-flag','true');

}, ays_pb_animation_close_speed);

}else{

$(document).find('.ays-pb-modal_2').css('display', 'none');

$(document).find('.ays-pb-modal_2').attr('data-ays-flag','true');

}

clearInterval(timer_pb_2);

}

$(document).find('.ays-pb-modal-close_2').one('click', function(){

if (pbViewsFlag_2) {

var pb_id = 2;$.ajax({

url: pbLocalizeObj.ajax,

method: 'POST',

dataType: 'text',

data: {

id: pb_id,

action: 'ays_increment_pb_views',

},

});pbViewsFlag_2 = false;

}

$(document).find('.av_pop_modals_2').css('pointer-events', 'none');

$(document).find('.ays-pb-modal_2').attr('class', 'ays-pb-modal ays-pb-modal-image-type-img ays-pb-modal_2 ays-pb-border-mobile_2 '+ays_pb_effectOut_2);

$(this).parents('.ays-pb-modals').find('iframe').each(function(){

var key = /https:\/\/www.youtube.com/;

var src = $(this).attr('src');

$(this).attr('src', $(this).attr('src'));

});

$(this).parents('.ays-pb-modals').find('video.wp-video-shortcode').each(function(){

if(typeof $(this).get(0) != 'undefined'){

if ( ! $(this).get(0).paused ) {

$(this).get(0).pause();

}

}

});

$(this).parents('.ays-pb-modals').find('audio.wp-audio-shortcode').each(function(){

if(typeof $(this).get(0) != 'undefined'){

if ( ! $(this).get(0).paused ) {

$(this).get(0).pause();

}

}

});

if(ays_pb_effectOut_2 != 'none'){

setTimeout(function(){

$(document).find('.ays-pb-modal_2').css('display', 'none');

$(document).find('.av_pop_modals_2').css('display', 'none');

$(document).find('.ays-pb-modal_2').attr('data-ays-flag','true');

if($('#ays_pb_close_sound_2').get(0) != undefined){

if(!$('#ays_pb_close_sound_2').get(0).paused){

$(document).find('.ays-pb-modal_2').css('display', 'none');

var audio = $('#ays_pb_close_sound_2').get(0);

audio.pause();

audio.currentTime = 0;

}

}

}, ays_pb_animation_close_speed);

}else{

$(document).find('.ays-pb-modal_2').css('display', 'none');

$(document).find('.av_pop_modals_2').css('display', 'none');

$(document).find('.ays-pb-modal_2').attr('data-ays-flag','true');

if($('#ays_pb_close_sound_2').get(0) != undefined){

if(!$('#ays_pb_close_sound_2').get(0).paused){

$(document).find('.ays-pb-modal_2').css('display', 'none');

var audio = $('#ays_pb_close_sound_2').get(0);

audio.pause();

audio.currentTime = 0;

}

}

}

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0', 'display': 'none'});

clearInterval(timer_pb_2);

});

var ays_pb_flag = true;

$(document).on('keydown', function(event) {

if('1' && ays_pb_flag){

var escClosingPopups = $(document).find('.ays-pb-close-popup-with-esc:visible');

if (event.keyCode == 27) {

var topmostPopup = escClosingPopups.last();

topmostPopup.find('.ays-pb-modal-close_2').trigger('click');

ays_pb_flag = false;

}

} else {

ays_pb_flag = true;

}

});

},1000);

}

}

});

}else{

if( ays_pb_delayOpen_2 !== 0 ){

$(document).find('.ays-pb-modal_2').css('animation-delay', ays_pb_delayOpen_2/1000);

setTimeout(function(){

$(document).find('.av_pop_modals_2').css('display','block');

$(document).find('.ays-pb-modal_2').addClass(ays_pb_effectIn_2);

$(document).find('.ays-pb-modal_2').css('display', 'block');

if (window.innerWidth < 768 && $(document).find('#ays-pb-screen-shade_2').attr('data-mobile-overlay') == 'true') {

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0.5'});

}

else{

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0.500000'});

}

$(document).find('.ays-pb-modal-check_2').attr('checked', 'checked');if(isPageScrollDisabled){

$(document).find('body').addClass('pb_disable_scroll_2');

$(document).find('html').removeClass('pb_enable_scroll');

}}, ays_pb_delayOpen_2);

} else {

if($(document).find('.ays_pb_abt_2').val() != 'clickSelector'){

$(document).find('.av_pop_modals_2').css('display','block');

$(document).find('.ays-pb-modal_2').addClass(ays_pb_effectIn_2);

$(document).find('.ays-pb-modal_2').css('display', 'block');

if (window.innerWidth < 768 && $(document).find('#ays-pb-screen-shade_2').attr('data-mobile-overlay') == 'true') {

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0.5'});

}

else{

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0.500000'});

}

$(document).find('.ays-pb-modal-check_2').attr('checked', 'checked');if(isPageScrollDisabled){

$(document).find('body').addClass('pb_disable_scroll_2');

$(document).find('html').addClass('pb_disable_scroll_2');

}

}

}

}

if ('On' != 'On'){

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0', 'display': 'none !important', 'pointer-events': 'none', 'background': 'none'});

$(document).find('.ays-pb-modal_2').css('pointer-events', 'auto');

$(document).find('.av_pop_modals_2').css('pointer-events','none');

};

if($(document).find('.ays-pb-modals video').hasClass('wp-video-shortcode')){

var videoWidth = $(document).find('.ays-pb-modals video.wp-video-shortcode').attr('width');

var videoHeight = $(document).find('.ays-pb-modals video.wp-video-shortcode').attr('height');

setTimeout(function(){

$(document).find('.ays-pb-modals .wp-video').removeAttr('style');

$(document).find('.ays-pb-modals .mejs-container').removeAttr('style');

$(document).find('.ays-pb-modals video.wp-video-shortcode').removeAttr('style');$(document).find('.ays-pb-modals .wp-video').css({'width': '100%'});

$(document).find('.ays-pb-modals .mejs-container').css({'width': '100%','height': videoHeight + 'px'});

$(document).find('.ays-pb-modals video.wp-video-shortcode').css({'width': '100%','height': videoHeight + 'px'});

},1000);

}

if($(document).find('.ays-pb-modals iframe').attr('style') != ''){

setTimeout(function(){

$(document).find('.ays-pb-modals iframe').removeAttr('style');

},500);

}

// if(5 == 0){

if(closePopupOverlay && 'On' == 'On'){

$(document).find('.av_pop_modals_2').on('click', function(e) {

var pb_parent = $(this);

var pb_div = $(this).find('.ays-pb-modal_2');

if (!pb_div.is(e.target) && pb_div.has(e.target).length === 0){

$(document).find('.ays-pb-modal-close_2').click();

}

});

}

var ays_pb_flag = true;

$(document).on('keydown', function(event) {

if('1' && ays_pb_flag){

var escClosingPopups = $(document).find('.ays-pb-close-popup-with-esc:visible');

if (event.keyCode == 27) {

var topmostPopup = escClosingPopups.last();

topmostPopup.find('.ays-pb-modal-close_2').trigger('click');

ays_pb_flag = false;

}

} else {

ays_pb_flag = true;

}

});

// }

if('off' == 'on') {

var video = $(document).find('video.wp-video-shortcode');

for (let i = 0; i < video.length; i++) {

video[i].addEventListener('ended', function() {

if ($(this).next().val() === 'on') {

$(this).parents('.ays_video_window').find('.close-image-btn').trigger('click');

}

});

}

}

jQuery(document).on('click', '.ays-pb-modal-close_2', function() {

$(document).find('body').removeClass('pb_disable_scroll_2');

$(document).find('html').removeClass('pb_disable_scroll_2');

});});

})( jQuery );

if(typeof aysPopupOptions === "undefined"){

var aysPopupOptions = [];

}

aysPopupOptions["2"] = "eyJwb3B1cGJveCI6eyJpZCI6IjIiLCJ0aXRsZSI6IkFkIiwicG9wdXBfbmFtZSI6IiIsImRlc2NyaXB0aW9uIjoiRGVtbyBEZXNjcmlwdGlvbiIsImNhdGVnb3J5X2lkIjoiMSIsImF1dG9jbG9zZSI6IjUiLCJjb29raWUiOiIxNDQwIiwid2lkdGgiOjQwMCwiaGVpZ2h0Ijo1MDAsImJnY29sb3IiOiIjZmZmZmZmIiwidGV4dGNvbG9yIjoiIzAwMDAwMCIsImJvcmRlcnNpemUiOiIxIiwiYm9yZGVyY29sb3IiOiIjZmZmZmZmIiwiYm9yZGVyX3JhZGl1cyI6IjQiLCJzaG9ydGNvZGUiOiIiLCJ1c2Vyc19yb2xlIjoiW10iLCJjdXN0b21fY2xhc3MiOiIiLCJjdXN0b21fY3NzIjoiIiwiY3VzdG9tX2h0bWwiOiJIZXJlIGNhbiBiZSB5b3VyIGN1c3RvbSBIVE1MIG9yIFNob3J0Y29kZSIsIm9ub2Zmc3dpdGNoIjoiT24iLCJzaG93X29ubHlfZm9yX2F1dGhvciI6Im9mZiIsInNob3dfYWxsIjoiYWxsIiwiZGVsYXkiOiIzIiwic2Nyb2xsX3RvcCI6IjAiLCJhbmltYXRlX2luIjoiZmFkZUluIiwiYW5pbWF0ZV9vdXQiOiJmYWRlT3V0IiwiYWN0aW9uX2J1dHRvbiI6IiIsInZpZXdfcGxhY2UiOiIiLCJhY3Rpb25fYnV0dG9uX3R5cGUiOiJwYWdlTG9hZGVkIiwibW9kYWxfY29udGVudCI6ImltYWdlX3R5cGUiLCJ2aWV3X3R5cGUiOiJpbWFnZV90eXBlX2ltZ190aGVtZSIsIm9ub2Zmb3ZlcmxheSI6Ik9uIiwib3ZlcmxheV9vcGFjaXR5IjoiMC41MDAwMDAiLCJzaG93X3BvcHVwX3RpdGxlIjoiT2ZmIiwic2hvd19wb3B1cF9kZXNjIjoiT2ZmIiwiY2xvc2VfYnV0dG9uIjoib2ZmIiwiaGVhZGVyX2JnY29sb3IiOiIjZmZmZmZmIiwiYmdfaW1hZ2UiOiIiLCJsb2dfdXNlciI6Ik9uIiwiZ3Vlc3QiOiJPbiIsImFjdGl2ZV9kYXRlX2NoZWNrIjoib2ZmIiwiYWN0aXZlSW50ZXJ2YWwiOiIyMDI0LTA0LTE5IDE2OjA0OjE3IiwiZGVhY3RpdmVJbnRlcnZhbCI6IjIwMjQtMDQtMTkgMTY6MDQ6MTciLCJwYl9wb3NpdGlvbiI6ImNlbnRlci1jZW50ZXIiLCJwYl9tYXJnaW4iOiIwIiwidmlld3MiOiI1MTgwMCIsImNvbnZlcnNpb25zIjoiMCIsIm9wdGlvbnMiOiJ7XCJlbmFibGVfYmFja2dyb3VuZF9ncmFkaWVudFwiOlwib2ZmXCIsXCJiYWNrZ3JvdW5kX2dyYWRpZW50X2NvbG9yXzFcIjpcIiMwMDBcIixcImJhY2tncm91bmRfZ3JhZGllbnRfY29sb3JfMlwiOlwiI2ZmZlwiLFwicGJfZ3JhZGllbnRfZGlyZWN0aW9uXCI6XCJ2ZXJ0aWNhbFwiLFwiZW5hYmxlX2JhY2tncm91bmRfZ3JhZGllbnRfbW9iaWxlXCI6XCJvZmZcIixcImJhY2tncm91bmRfZ3JhZGllbnRfY29sb3JfMV9tb2JpbGVcIjpcIiMwMDBcIixcImJhY2tncm91bmRfZ3JhZGllbnRfY29sb3JfMl9tb2JpbGVcIjpcIiNmZmZcIixcInBiX2dyYWRpZW50X2RpcmVjdGlvbl9tb2JpbGVcIjpcInZlcnRpY2FsXCIsXCJleGNlcHRfcG9zdF90eXBlc1wiOltdLFwiZXhjZXB0X3Bvc3RzXCI6W10sXCJhbGxfcG9zdHNcIjpcIlwiLFwiY2xvc2VfYnV0dG9uX2RlbGF5XCI6MCxcImNsb3NlX2J1dHRvbl9kZWxheV9mb3JfbW9iaWxlXCI6MCxcImVuYWJsZV9jbG9zZV9idXR0b25fZGVsYXlfZm9yX21vYmlsZVwiOlwib2ZmXCIsXCJlbmFibGVfcGJfc291bmRcIjpcIm9mZlwiLFwib3ZlcmxheV9jb2xvclwiOlwiIzAwMFwiLFwiZW5hYmxlX292ZXJsYXlfY29sb3JfbW9iaWxlXCI6XCJvZmZcIixcIm92ZXJsYXlfY29sb3JfbW9iaWxlXCI6XCIjMDAwXCIsXCJhbmltYXRpb25fc3BlZWRcIjoxLFwiZW5hYmxlX2FuaW1hdGlvbl9zcGVlZF9tb2JpbGVcIjpcIm9mZlwiLFwiYW5pbWF0aW9uX3NwZWVkX21vYmlsZVwiOjEsXCJjbG9zZV9hbmltYXRpb25fc3BlZWRcIjoxLFwiZW5hYmxlX2Nsb3NlX2FuaW1hdGlvbl9zcGVlZF9tb2JpbGVcIjpcIm9mZlwiLFwiY2xvc2VfYW5pbWF0aW9uX3NwZWVkX21vYmlsZVwiOjEsXCJwYl9tb2JpbGVcIjpcIm9mZlwiLFwiY2xvc2VfYnV0dG9uX3RleHRcIjpcIlxcdTI3MTVcIixcImVuYWJsZV9jbG9zZV9idXR0b25fdGV4dF9tb2JpbGVcIjpcIm9uXCIsXCJjbG9zZV9idXR0b25fdGV4dF9tb2JpbGVcIjpcIlxcdTI3MTVcIixcImNsb3NlX2J1dHRvbl9ob3Zlcl90ZXh0XCI6XCJcIixcIm1vYmlsZV93aWR0aFwiOlwiXCIsXCJtb2JpbGVfbWF4X3dpZHRoXCI6XCJcIixcIm1vYmlsZV9oZWlnaHRcIjpcIlwiLFwiY2xvc2VfYnV0dG9uX3Bvc2l0aW9uXCI6XCJyaWdodC10b3BcIixcImVuYWJsZV9jbG9zZV9idXR0b25fcG9zaXRpb25fbW9iaWxlXCI6XCJvZmZcIixcImNsb3NlX2J1dHRvbl9wb3NpdGlvbl9tb2JpbGVcIjpcInJpZ2h0LXRvcFwiLFwic2hvd19vbmx5X29uY2VcIjpcIm9mZlwiLFwic2hvd19vbl9ob21lX3BhZ2VcIjpcIm9mZlwiLFwiY2xvc2VfcG9wdXBfZXNjXCI6XCJvblwiLFwicG9wdXBfd2lkdGhfYnlfcGVyY2VudGFnZV9weFwiOlwicGl4ZWxzXCIsXCJwb3B1cF9jb250ZW50X3BhZGRpbmdcIjowLFwicG9wdXBfcGFkZGluZ19ieV9wZXJjZW50YWdlX3B4XCI6XCJwaXhlbHNcIixcInBiX2ZvbnRfZmFtaWx5XCI6XCJpbmhlcml0XCIsXCJjbG9zZV9wb3B1cF9vdmVybGF5XCI6XCJvblwiLFwiY2xvc2VfcG9wdXBfb3ZlcmxheV9tb2JpbGVcIjpcIm9uXCIsXCJlbmFibGVfcGJfZnVsbHNjcmVlblwiOlwib2ZmXCIsXCJlbmFibGVfaGlkZV90aW1lclwiOlwib2ZmXCIsXCJlbmFibGVfaGlkZV90aW1lcl9tb2JpbGVcIjpcIm9mZlwiLFwiZW5hYmxlX2F1dG9jbG9zZV9vbl9jb21wbGV0aW9uXCI6XCJvZmZcIixcImVuYWJsZV9zb2NpYWxfbGlua3NcIjpcIm9mZlwiLFwic29jaWFsX2xpbmtzXCI6e1wibGlua2VkaW5fbGlua1wiOlwiXCIsXCJmYWNlYm9va19saW5rXCI6XCJcIixcInR3aXR0ZXJfbGlua1wiOlwiXCIsXCJ2a29udGFrdGVfbGlua1wiOlwiXCIsXCJ5b3V0dWJlX2xpbmtcIjpcIlwiLFwiaW5zdGFncmFtX2xpbmtcIjpcIlwiLFwiYmVoYW5jZV9saW5rXCI6XCJcIn0sXCJzb2NpYWxfYnV0dG9uc19oZWFkaW5nXCI6XCJcIixcImNsb3NlX2J1dHRvbl9zaXplXCI6MSxcImNsb3NlX2J1dHRvbl9pbWFnZVwiOlwiXCIsXCJib3JkZXJfc3R5bGVcIjpcInNvbGlkXCIsXCJlbmFibGVfYm9yZGVyX3N0eWxlX21vYmlsZVwiOlwib2ZmXCIsXCJib3JkZXJfc3R5bGVfbW9iaWxlXCI6XCJzb2xpZFwiLFwiYXlzX3BiX2hvdmVyX3Nob3dfY2xvc2VfYnRuXCI6XCJvZmZcIixcImRpc2FibGVfc2Nyb2xsXCI6XCJvZmZcIixcImRpc2FibGVfc2Nyb2xsX21vYmlsZVwiOlwib2ZmXCIsXCJlbmFibGVfb3Blbl9kZWxheV9tb2JpbGVcIjpcIm9mZlwiLFwib3Blbl9kZWxheV9tb2JpbGVcIjpcIjBcIixcImVuYWJsZV9zY3JvbGxfdG9wX21vYmlsZVwiOlwib2ZmXCIsXCJzY3JvbGxfdG9wX21vYmlsZVwiOlwiMFwiLFwiZW5hYmxlX3BiX3Bvc2l0aW9uX21vYmlsZVwiOlwib2ZmXCIsXCJwYl9wb3NpdGlvbl9tb2JpbGVcIjpcImNlbnRlci1jZW50ZXJcIixcInBiX2JnX2ltYWdlX3Bvc2l0aW9uXCI6XCJjZW50ZXItY2VudGVyXCIsXCJlbmFibGVfcGJfYmdfaW1hZ2VfcG9zaXRpb25fbW9iaWxlXCI6XCJvZmZcIixcInBiX2JnX2ltYWdlX3Bvc2l0aW9uX21vYmlsZVwiOlwiY2VudGVyLWNlbnRlclwiLFwicGJfYmdfaW1hZ2Vfc2l6aW5nXCI6XCJjb3ZlclwiLFwiZW5hYmxlX3BiX2JnX2ltYWdlX3NpemluZ19tb2JpbGVcIjpcIm9mZlwiLFwicGJfYmdfaW1hZ2Vfc2l6aW5nX21vYmlsZVwiOlwiY292ZXJcIixcInZpZGVvX3RoZW1lX3VybFwiOlwiXCIsXCJpbWFnZV90eXBlX2ltZ19zcmNcIjpcImh0dHBzOlxcXC9cXFwvd3d3LnVuaXF1ZW5ld3NvbmxpbmUuY29tXFxcL3dwLWNvbnRlbnRcXFwvdXBsb2Fkc1xcXC8yMDI0XFxcLzA0XFxcL2Jhbm5lci1zYXRzc3BvcnRzLmpwZ1wiLFwiaW1hZ2VfdHlwZV9pbWdfcmVkaXJlY3RfdXJsXCI6XCJodHRwczpcXFwvXFxcL3d3dy5zYXRzcG9ydC5jb21cXFwveFxcXC8jXFxcLzJcXFwvaG9tZVxcXC9leGNoYW5nZVxcXC9zcG9ydFxcXC9hbGw/c2lnbnVwPXRydWUmdXRtX3NvdXJjZT11bmlxdWVuZXdzb25saW5lJnV0bV9tZWRpdW09dW5pcXVlbmV3c29ubGluZVwiLFwiZmFjZWJvb2tfcGFnZV91cmxcIjpcImh0dHBzOlxcXC9cXFwvd3d3LmZhY2Vib29rLmNvbVxcXC93b3JkcHJlc3NcIixcImhpZGVfZmJfcGFnZV9jb3Zlcl9waG90b1wiOlwib2ZmXCIsXCJub3RpZmljYXRpb25fdHlwZV9jb21wb25lbnRzXCI6W10sXCJub3RpZmljYXRpb25fdHlwZV9jb21wb25lbnRzX29yZGVyXCI6e1wibWFpbl9jb250ZW50XCI6XCJtYWluX2NvbnRlbnRcIixcImJ1dHRvbl8xXCI6XCJidXR0b25fMVwifSxcIm5vdGlmaWNhdGlvbl9tYWluX2NvbnRlbnRcIjpcIldyaXRlIHRoZSBjdXN0b20gbm90aWZpY2F0aW9uIGJhbm5lciB0ZXh0IGhlcmUuXCIsXCJub3RpZmljYXRpb25fYnV0dG9uXzFfdGV4dFwiOlwiQ2xpY2shXCIsXCJub3RpZmljYXRpb25fYnV0dG9uXzFfcmVkaXJlY3RfdXJsXCI6XCJcIixcInBiX21heF9oZWlnaHRcIjpcIlwiLFwicG9wdXBfbWF4X2hlaWdodF9ieV9wZXJjZW50YWdlX3B4XCI6XCJwaXhlbHNcIixcInBiX21heF9oZWlnaHRfbW9iaWxlXCI6XCJcIixcInBvcHVwX21heF9oZWlnaHRfYnlfcGVyY2VudGFnZV9weF9tb2JpbGVcIjpcInBpeGVsc1wiLFwicGJfbWluX2hlaWdodFwiOlwiXCIsXCJwYl9mb250X3NpemVcIjoxMyxcInBiX2ZvbnRfc2l6ZV9mb3JfbW9iaWxlXCI6MTMsXCJwYl90aXRsZV90ZXh0X3NoYWRvd1wiOlwicmdiYSgyNTUsMjU1LDI1NSwwKVwiLFwiZW5hYmxlX3BiX3RpdGxlX3RleHRfc2hhZG93XCI6XCJvZmZcIixcInBiX3RpdGxlX3RleHRfc2hhZG93X3hfb2Zmc2V0XCI6MixcInBiX3RpdGxlX3RleHRfc2hhZG93X3lfb2Zmc2V0XCI6MixcInBiX3RpdGxlX3RleHRfc2hhZG93X3pfb2Zmc2V0XCI6MCxcInBiX3RpdGxlX3RleHRfc2hhZG93X21vYmlsZVwiOlwicmdiYSgyNTUsMjU1LDI1NSwwKVwiLFwiZW5hYmxlX3BiX3RpdGxlX3RleHRfc2hhZG93X21vYmlsZVwiOlwib2ZmXCIsXCJwYl90aXRsZV90ZXh0X3NoYWRvd194X29mZnNldF9tb2JpbGVcIjoyLFwicGJfdGl0bGVfdGV4dF9zaGFkb3dfeV9vZmZzZXRfbW9iaWxlXCI6MixcInBiX3RpdGxlX3RleHRfc2hhZG93X3pfb2Zmc2V0X21vYmlsZVwiOjAsXCJjcmVhdGVfZGF0ZVwiOlwiMjAyNC0wNC0xNyAyMDoyOTo1NlwiLFwiY3JlYXRlX2F1dGhvclwiOjMsXCJhdXRob3JcIjpcIntcXFwiaWRcXFwiOlxcXCIzXFxcIixcXFwibmFtZVxcXCI6XFxcIkRyLiBZb2dlbmRyYSBEZXN3YXJcXFwifVwiLFwiZW5hYmxlX2Rpc21pc3NcIjpcIm9mZlwiLFwiZW5hYmxlX2Rpc21pc3NfdGV4dFwiOlwiRGlzbWlzcyBhZFwiLFwiZW5hYmxlX2Rpc21pc3NfbW9iaWxlXCI6XCJvZmZcIixcImVuYWJsZV9kaXNtaXNzX3RleHRfbW9iaWxlXCI6XCJEaXNtaXNzIGFkXCIsXCJlbmFibGVfYm94X3NoYWRvd1wiOlwib2ZmXCIsXCJlbmFibGVfYm94X3NoYWRvd19tb2JpbGVcIjpcIm9mZlwiLFwiYm94X3NoYWRvd19jb2xvclwiOlwiIzAwMFwiLFwiYm94X3NoYWRvd19jb2xvcl9tb2JpbGVcIjpcIiMwMDBcIixcInBiX2JveF9zaGFkb3dfeF9vZmZzZXRcIjowLFwicGJfYm94X3NoYWRvd194X29mZnNldF9tb2JpbGVcIjowLFwicGJfYm94X3NoYWRvd195X29mZnNldFwiOjAsXCJwYl9ib3hfc2hhZG93X3lfb2Zmc2V0X21vYmlsZVwiOjAsXCJwYl9ib3hfc2hhZG93X3pfb2Zmc2V0XCI6MTUsXCJwYl9ib3hfc2hhZG93X3pfb2Zmc2V0X21vYmlsZVwiOjE1LFwiZGlzYWJsZV9zY3JvbGxfb25fcG9wdXBcIjpcIm9mZlwiLFwiZGlzYWJsZV9zY3JvbGxfb25fcG9wdXBfbW9iaWxlXCI6XCJvZmZcIixcInNob3dfc2Nyb2xsYmFyXCI6XCJvZmZcIixcImhpZGVfb25fcGNcIjpcIm9mZlwiLFwiaGlkZV9vbl90YWJsZXRzXCI6XCJvZmZcIixcInBiX2JnX2ltYWdlX2RpcmVjdGlvbl9vbl9tb2JpbGVcIjpcIm9uXCIsXCJjbG9zZV9idXR0b25fY29sb3JcIjpcIiMwMDAwMDBcIixcImNsb3NlX2J1dHRvbl9ob3Zlcl9jb2xvclwiOlwiIzAwMDAwMFwiLFwiYmx1cmVkX292ZXJsYXlcIjpcIm9mZlwiLFwiYmx1cmVkX292ZXJsYXlfbW9iaWxlXCI6XCJvZmZcIixcInBiX2F1dG9jbG9zZV9tb2JpbGVcIjpcIjBcIixcImVuYWJsZV9hdXRvY2xvc2VfZGVsYXlfdGV4dF9tb2JpbGVcIjpcIm9mZlwiLFwiZW5hYmxlX292ZXJsYXlfdGV4dF9tb2JpbGVcIjpcIm9mZlwiLFwib3ZlcmxheV9tb2JpbGVfb3BhY2l0eVwiOlwiMC41XCIsXCJzaG93X3BvcHVwX3RpdGxlX21vYmlsZVwiOlwiT2ZmXCIsXCJzaG93X3BvcHVwX2Rlc2NfbW9iaWxlXCI6XCJPZmZcIixcImVuYWJsZV9hbmltYXRlX2luX21vYmlsZVwiOlwib2ZmXCIsXCJhbmltYXRlX2luX21vYmlsZVwiOlwiZmFkZUluXCIsXCJlbmFibGVfYW5pbWF0ZV9vdXRfbW9iaWxlXCI6XCJvZmZcIixcImFuaW1hdGVfb3V0X21vYmlsZVwiOlwiZmFkZU91dFwiLFwiZW5hYmxlX2Rpc3BsYXlfY29udGVudF9tb2JpbGVcIjpcIm9mZlwiLFwiZW5hYmxlX2JnY29sb3JfbW9iaWxlXCI6XCJvZmZcIixcImJnY29sb3JfbW9iaWxlXCI6XCIjZmZmZmZmXCIsXCJlbmFibGVfYmdfaW1hZ2VfbW9iaWxlXCI6XCJvZmZcIixcImJnX2ltYWdlX21vYmlsZVwiOlwiXCIsXCJlbmFibGVfYm9yZGVyY29sb3JfbW9iaWxlXCI6XCJvZmZcIixcImJvcmRlcmNvbG9yX21vYmlsZVwiOlwiI2ZmZmZmZlwiLFwiZW5hYmxlX2JvcmRlcnNpemVfbW9iaWxlXCI6XCJvZmZcIixcImJvcmRlcnNpemVfbW9iaWxlXCI6XCIxXCIsXCJlbmFibGVfYm9yZGVyX3JhZGl1c19tb2JpbGVcIjpcIm9mZlwiLFwiYm9yZGVyX3JhZGl1c19tb2JpbGVcIjpcIjRcIn0iLCJzaG93X3BvcHVwX3RpdGxlX21vYmlsZSI6Ik9mZiIsInNob3dfcG9wdXBfZGVzY19tb2JpbGUiOiJPZmYifX0=";

!function(){const e=document.createElement("script");e.async=!0,e.setAttribute("crossorigin","anonymous"),e.src="//pagead2.googlesyndication.com/pagead/js/adsbygoogle.js?client=ca-pub-9548258067481809";let t=0;document.addEventListener("mousemove",function(){1==++t&&document.getElementsByTagName("HEAD").item(0).appendChild(e)}),window.onscroll=function(n){1==++t&&document.getElementsByTagName("HEAD").item(0).appendChild(e)},setTimeout(function(){0===t&&(t++,document.getElementsByTagName("HEAD").item(0).appendChild(e))},5e3)}();

https://www.uniquenewsonline.com/wp-content/plugins/theia-sticky-sidebar/js/ResizeSensor.js

https://www.uniquenewsonline.com/wp-content/plugins/theia-sticky-sidebar/js/theia-sticky-sidebar.js

https://www.uniquenewsonline.com/wp-content/plugins/theia-sticky-sidebar/js/main.js

https://www.uniquenewsonline.com/wp-content/themes/zox-news/js/mvpcustom.js

jQuery(document).ready(function($) {

var leaderHeight = $("#mvp-leader-wrap").outerHeight();

var navHeight = $("#mvp-main-head-wrap").outerHeight();

var headerHeight = navHeight + leaderHeight;

var previousScroll = 0;

$(window).scroll(function(event){

var scroll = $(this).scrollTop();

if ( typeof leaderHeight !== "undefined" ) {

if ($(window).scrollTop() > headerHeight){

$("#mvp-main-nav-small").addClass("mvp-nav-small-fixed");

$("#mvp-main-body-wrap").css("margin-top", navHeight );

} else {

$("#mvp-main-nav-small").removeClass("mvp-nav-small-fixed");

$("#mvp-main-body-wrap").css("margin-top","0");

}

if ($(window).scrollTop() > headerHeight + 50){

$("#mvp-main-nav-small").addClass("mvp-fixed");

$("#mvp-main-nav-small").addClass("mvp-fixed-shadow");

$(".mvp-fly-top").addClass("mvp-to-top");

} else {

$("#mvp-main-nav-small").removeClass("mvp-fixed");

$("#mvp-main-nav-small").removeClass("mvp-fixed-shadow");

$(".mvp-fly-top").removeClass("mvp-to-top");

}

} else {

if ($(window).scrollTop() > navHeight){

$("#mvp-main-nav-small").addClass("mvp-nav-small-fixed");

$("#mvp-main-body-wrap").css("margin-top", navHeight );

} else {

$("#mvp-main-nav-small").removeClass("mvp-nav-small-fixed");

$("#mvp-main-body-wrap").css("margin-top","0");

}

if ($(window).scrollTop() > navHeight + 50){

$("#mvp-main-nav-small").addClass("mvp-fixed");

$("#mvp-main-nav-small").addClass("mvp-fixed-shadow");

$(".mvp-fly-top").addClass("mvp-to-top");

} else {

$("#mvp-main-nav-small").removeClass("mvp-fixed");

$("#mvp-main-nav-small").removeClass("mvp-fixed-shadow");

$(".mvp-fly-top").removeClass("mvp-to-top");

}

}

previousScroll = scroll;

});

});jQuery(document).ready(function($) {

// Mobile Social Buttons More

$(".mvp-soc-mob-right").on("click", function(){

$("#mvp-soc-mob-wrap").toggleClass("mvp-soc-mob-more");

});

});jQuery(document).ready(function($) {

$(".menu-item-has-children a").click(function(event){

event.stopPropagation();});$(".menu-item-has-children").click(function(){

$(this).addClass("toggled");

if($(".menu-item-has-children").hasClass("toggled"))

{

$(this).children("ul").toggle();

$(".mvp-fly-nav-menu").getNiceScroll().resize();

}

$(this).toggleClass("tog-minus");

return false;

});// Main Menu Scroll

$(".mvp-fly-nav-menu").niceScroll({cursorcolor:"#888",cursorwidth: 7,cursorborder: 0,zindex:999999});

});

https://www.uniquenewsonline.com/wp-content/themes/zox-news/js/scripts.js

https://www.uniquenewsonline.com/wp-content/themes/zox-news/js/retina.js

https://www.uniquenewsonline.com/wp-includes/js/comment-reply.min.js

(function(w,d, s, id) {w.webpushr=w.webpushr||function(){(w.webpushr.q=w.webpushr.q||[]).push(arguments)};var js, fjs = d.getElementsByTagName(s)[0];js = d.createElement(s); js.async=1; js.id = id;js.src = "https://cdn.webpushr.com/app.min.js";

d.body.appendChild(js);}(window,document, 'script', 'webpushr-jssdk'));

webpushr('setup',{'key':'BPjbvHzuEYRqFV4yiEu3fIxgQ_hu6jxsQjNdj6baiXPpbFathx1pQk1KL7M1lXEoliGJckK0dG6UeYUZuTIiCRQ','sw':'https://www.uniquenewsonline.com/wp-content/plugins/webpushr-web-push-notifications/sdk_files/webpushr-sw.js.php'});

window.lazyLoadOptions = {

elements_selector: "iframe[data-lazy-src]",

data_src: "lazy-src",

data_srcset: "lazy-srcset",

data_sizes: "lazy-sizes",

class_loading: "lazyloading",

class_loaded: "lazyloaded",

threshold: 300,

callback_loaded: function(element) {

if ( element.tagName === "IFRAME" && element.dataset.rocketLazyload == "fitvidscompatible" ) {

if (element.classList.contains("lazyloaded") ) {

if (typeof window.jQuery != "undefined") {

if (jQuery.fn.fitVids) {

jQuery(element).parent().fitVids();

}

}

}

}

}};

window.addEventListener('LazyLoad::Initialized', function (e) {

var lazyLoadInstance = e.detail.instance;if (window.MutationObserver) {

var observer = new MutationObserver(function(mutations) {

var image_count = 0;

var iframe_count = 0;

var rocketlazy_count = 0;mutations.forEach(function(mutation) {

for (i = 0; i < mutation.addedNodes.length; i++) {

if (typeof mutation.addedNodes[i].getElementsByTagName !== 'function') {

return;

}if (typeof mutation.addedNodes[i].getElementsByClassName !== 'function') {

return;

}images = mutation.addedNodes[i].getElementsByTagName('img');

is_image = mutation.addedNodes[i].tagName == "IMG";

iframes = mutation.addedNodes[i].getElementsByTagName('iframe');

is_iframe = mutation.addedNodes[i].tagName == "IFRAME";

rocket_lazy = mutation.addedNodes[i].getElementsByClassName('rocket-lazyload');image_count += images.length;

iframe_count += iframes.length;

rocketlazy_count += rocket_lazy.length;if(is_image){

image_count += 1;

}if(is_iframe){

iframe_count += 1;

}

}

} );if(image_count > 0 || iframe_count > 0 || rocketlazy_count > 0){

lazyLoadInstance.update();

}

} );var b = document.getElementsByTagName("body")[0];

var config = { childList: true, subtree: true };observer.observe(b, config);

}

}, false);

https://www.uniquenewsonline.com/wp-content/plugins/rocket-lazy-load/assets/js/16.1/lazyload.min.js