window._wpemojiSettings = {"baseUrl":"https:\/\/s.w.org\/images\/core\/emoji\/15.0.3\/72x72\/","ext":".png","svgUrl":"https:\/\/s.w.org\/images\/core\/emoji\/15.0.3\/svg\/","svgExt":".svg","source":{"concatemoji":"https:\/\/www.uniquenewsonline.com\/wp-includes\/js\/wp-emoji-release.min.js?ver=6.5.3"}};

/*! This file is auto-generated */

!function(i,n){var o,s,e;function c(e){try{var t={supportTests:e,timestamp:(new Date).valueOf()};sessionStorage.setItem(o,JSON.stringify(t))}catch(e){}}function p(e,t,n){e.clearRect(0,0,e.canvas.width,e.canvas.height),e.fillText(t,0,0);var t=new Uint32Array(e.getImageData(0,0,e.canvas.width,e.canvas.height).data),r=(e.clearRect(0,0,e.canvas.width,e.canvas.height),e.fillText(n,0,0),new Uint32Array(e.getImageData(0,0,e.canvas.width,e.canvas.height).data));return t.every(function(e,t){return e===r[t]})}function u(e,t,n){switch(t){case"flag":return n(e,"\ud83c\udff3\ufe0f\u200d\u26a7\ufe0f","\ud83c\udff3\ufe0f\u200b\u26a7\ufe0f")?!1:!n(e,"\ud83c\uddfa\ud83c\uddf3","\ud83c\uddfa\u200b\ud83c\uddf3")&&!n(e,"\ud83c\udff4\udb40\udc67\udb40\udc62\udb40\udc65\udb40\udc6e\udb40\udc67\udb40\udc7f","\ud83c\udff4\u200b\udb40\udc67\u200b\udb40\udc62\u200b\udb40\udc65\u200b\udb40\udc6e\u200b\udb40\udc67\u200b\udb40\udc7f");case"emoji":return!n(e,"\ud83d\udc26\u200d\u2b1b","\ud83d\udc26\u200b\u2b1b")}return!1}function f(e,t,n){var r="undefined"!=typeof WorkerGlobalScope&&self instanceof WorkerGlobalScope?new OffscreenCanvas(300,150):i.createElement("canvas"),a=r.getContext("2d",{willReadFrequently:!0}),o=(a.textBaseline="top",a.font="600 32px Arial",{});return e.forEach(function(e){o[e]=t(a,e,n)}),o}function t(e){var t=i.createElement("script");t.src=e,t.defer=!0,i.head.appendChild(t)}"undefined"!=typeof Promise&&(o="wpEmojiSettingsSupports",s=["flag","emoji"],n.supports={everything:!0,everythingExceptFlag:!0},e=new Promise(function(e){i.addEventListener("DOMContentLoaded",e,{once:!0})}),new Promise(function(t){var n=function(){try{var e=JSON.parse(sessionStorage.getItem(o));if("object"==typeof e&&"number"==typeof e.timestamp&&(new Date).valueOf()<e.timestamp+604800&&"object"==typeof e.supportTests)return e.supportTests}catch(e){}return null}();if(!n){if("undefined"!=typeof Worker&&"undefined"!=typeof OffscreenCanvas&&"undefined"!=typeof URL&&URL.createObjectURL&&"undefined"!=typeof Blob)try{var e="postMessage("+f.toString()+"("+[JSON.stringify(s),u.toString(),p.toString()].join(",")+"));",r=new Blob([e],{type:"text/javascript"}),a=new Worker(URL.createObjectURL(r),{name:"wpTestEmojiSupports"});return void(a.onmessage=function(e){c(n=e.data),a.terminate(),t(n)})}catch(e){}c(n=f(s,u,p))}t(n)}).then(function(e){for(var t in e)n.supports[t]=e[t],n.supports.everything=n.supports.everything&&n.supports[t],"flag"!==t&&(n.supports.everythingExceptFlag=n.supports.everythingExceptFlag&&n.supports[t]);n.supports.everythingExceptFlag=n.supports.everythingExceptFlag&&!n.supports.flag,n.DOMReady=!1,n.readyCallback=function(){n.DOMReady=!0}}).then(function(){return e}).then(function(){var e;n.supports.everything||(n.readyCallback(),(e=n.source||{}).concatemoji?t(e.concatemoji):e.wpemoji&&e.twemoji&&(t(e.twemoji),t(e.wpemoji)))}))}((window,document),window._wpemojiSettings);

https://www.uniquenewsonline.com/wp-includes/js/jquery/jquery.min.js

https://www.uniquenewsonline.com/wp-includes/js/jquery/jquery-migrate.min.js

var pbLocalizeObj = {"ajax":"https:\/\/www.uniquenewsonline.com\/wp-admin\/admin-ajax.php","seconds":"seconds","thisWillClose":"This will close in","icons":{"close_icon":"<svg class=\"ays_pb_material_close_icon\" xmlns=\"https:\/\/www.w3.org\/2000\/svg\" height=\"36px\" viewBox=\"0 0 24 24\" width=\"36px\" fill=\"#000000\" alt=\"Pop-up Close\"><path d=\"M0 0h24v24H0z\" fill=\"none\"\/><path d=\"M19 6.41L17.59 5 12 10.59 6.41 5 5 6.41 10.59 12 5 17.59 6.41 19 12 13.41 17.59 19 19 17.59 13.41 12z\"\/><\/svg>","close_circle_icon":"<svg class=\"ays_pb_material_close_circle_icon\" xmlns=\"https:\/\/www.w3.org\/2000\/svg\" height=\"24\" viewBox=\"0 0 24 24\" width=\"36\" alt=\"Pop-up Close\"><path d=\"M0 0h24v24H0z\" fill=\"none\"\/><path d=\"M12 2C6.47 2 2 6.47 2 12s4.47 10 10 10 10-4.47 10-10S17.53 2 12 2zm5 13.59L15.59 17 12 13.41 8.41 17 7 15.59 10.59 12 7 8.41 8.41 7 12 10.59 15.59 7 17 8.41 13.41 12 17 15.59z\"\/><\/svg>","volume_up_icon":"<svg class=\"ays_pb_fa_volume\" xmlns=\"https:\/\/www.w3.org\/2000\/svg\" height=\"24\" viewBox=\"0 0 24 24\" width=\"36\"><path d=\"M0 0h24v24H0z\" fill=\"none\"\/><path d=\"M3 9v6h4l5 5V4L7 9H3zm13.5 3c0-1.77-1.02-3.29-2.5-4.03v8.05c1.48-.73 2.5-2.25 2.5-4.02zM14 3.23v2.06c2.89.86 5 3.54 5 6.71s-2.11 5.85-5 6.71v2.06c4.01-.91 7-4.49 7-8.77s-2.99-7.86-7-8.77z\"\/><\/svg>","volume_mute_icon":"<svg xmlns=\"https:\/\/www.w3.org\/2000\/svg\" height=\"24\" viewBox=\"0 0 24 24\" width=\"24\"><path d=\"M0 0h24v24H0z\" fill=\"none\"\/><path d=\"M7 9v6h4l5 5V4l-5 5H7z\"\/><\/svg>"}};

https://www.uniquenewsonline.com/wp-content/plugins/ays-popup-box/public/js/ays-pb-public.js

var breeze_prefetch = {"local_url":"https:\/\/www.uniquenewsonline.com","ignore_remote_prefetch":"1","ignore_list":["\/wp-admin\/"]};

https://www.uniquenewsonline.com/wp-content/plugins/breeze/assets/js/js-front-end/breeze-prefetch-links.min.js

Unique News Online

New Tax Rules Will Be Effective From April 1: Here’s All You Need To Know On Taxes For Different Slabs

New Tax Rules Will Be Effective From April 1: Here’s All You Need To Know On Taxes For Different Slabs Published

1 month ago on

March 30, 2024 Today is the last working day of the financial year 2023-2024. April 1 will mark the first day of the financial year 2024-2025. Being an election year, the supplementary Budget bill was tabled in Parliament in February by Finance Minister Nirmala Sitharaman. The Finance Minister proposed a number of changes in the tax regimes that will become effective from April 1, 2024. Here’s a look at some of the changes in tax rules that will be effective from April 1:

The new tax regimes have been proposed to streamline the tax filing procedure and widen the participation of people in the new tax regime. However, taxpayers have the option to stick to the older tax regime if it is more beneficial for them.

The Tax slabs are as follows :Income from ₹3 lakh to ₹6 lakh – A 5% tax on the total amount Income from ₹6 lakh to ₹9 A 10% tax on the total amount Income from ₹9 lakh to ₹12 A 15% tax on the total amount Income from ₹12 lakh to ₹15 lakh A 20% tax on the total amount Income above ₹15 lakh and above A 30% tax on the total amount

The salient featured of the new tax regime is as follows-

The standard deduction, which was available in the previous tax regime at ₹50,000, has been incorporated into the new tax regime as well. This will be beneficial as it will further reduce taxable income. The surcharge on income above ₹5 crore has been reduced from 37% to 25%. Also, maturity benefits from life insurance policies issued on or after April 1, 2023, whose premiums exceed ₹5 lakh, will be subject to taxation. Leave encashment tax benefits for non-government employees have been increased from ₹3 lakh to ₹25 lakh. Income tax exemption limit is :Rs 2,50,000 for Persons below 60 years of age, HUFs, and NRIs. Rs 3,00,000 for citizens aged above 60 years but less than 80 years. Rs 5,00,000 for very senior citizens aged above 80 years. Surcharge and cess will be applicable over and above the tax rates.

Manoj Nair: With a decade of news writing across various media platforms, Manoj is a seasoned professional. His dual role as an English teacher underscores his command over communication. He adeptly covers Politics, Technology, Crypto, and more, reflecting a broad and insightful perspective that engages and informs diverse audiences.

Galgotias University Students Protest Against ‘Urban Maxwell’ Triggered Meme Fest! Published

5 days ago on

May 3, 2024 The internet is currently divided following a viral video that showed remarks by students from Galgotias University about Sam Pitroda, the Chair of the Indian Overseas Congress, regarding the ‘inheritance tax’.

As per Business Standard , this incident that has filled the entire nation with laughter took place in Greater Noida. Purposedly, the students of Galgotias University held a protest in Delhi.

Galgotias University Students Rally With ‘Unclear’ Agenda Spark Meme Frenzy When an AajTak reporter reached the protest site, he questioned the students engaged in the protests. The reporter asked the students the motive behind their protest and the message their placards conveyed.

Students seemed clueless about the questions asked. While responses from other students were even funny and laughable.

Thus, the video showcasing students’ response has gone viral all over the social media platforms. The video has also garnered funny reactions from netizens online.

Meme Fest All Over the Internet When the students were questioned, their relies on were just a comedy of errors.

One student stated that his motive behind the protest was his desire for a developed India. However, he lacked the basic specifics.

Another student acknowledged that he was clueless regarding the Congress manifesto. Several protestors even struggled to read what was printed on their placards.

When a student was asked to read the slogan written on the placard, the student read ‘urban naxal’ as ‘urban maxwell.’

It seemed that the protest was made to touch a range of issues in the nation, such as women’s empowerment, urban naxalism, NaMo’s stand on mangalsutra and wealth redistribution, inheritance tax and many more. However, clarity remains elusive.

Videos circulating on social media garnered mixed reactions. Some laughed while others their criticism and showed disappointment at the students’ lack of awareness.

Responses received from students even triggered a meme fest all over the internet. Take a look!

Also Read: Christopher Bouie Jr Video: Minor Arrested For Sanford, Florida Shooting Leaving 10 Injured

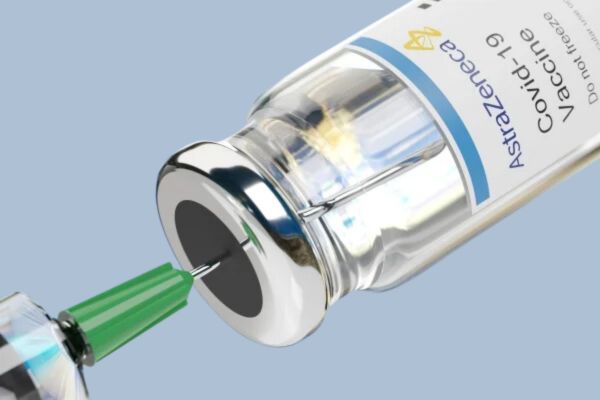

AstraZeneca’s Covishield To Cause Rare Yet Serious Side Effects Published

6 days ago on

May 2, 2024 A huge update for those who were a part of COVID vaccination programs! Rare side effects of the vaccination have surfaced, questioned by numerous health experts.

The Economic Times reported that AstraZeneca, the British-Swedish multinational pharmaceutical and biotechnology company, has legally acknowledged that its product, Covishield, can cause certain rare side effects.

AstraZeneca developed Covishield, which was produced by the Serum Institute of India. In India, Covishield was one of the primary vaccines provided to citizens.

AstraZeneca’s Statements AstraZeneca is currently facing a lawsuit in a UK court. The lawsuit was filed after claims surfaced on the internet that AstraZeneca’s vaccine caused deaths. To date, 51 deaths have been reported, hence 51 cases have been filed against the company.

AstraZeneca finally admitted in one of the court papers that, “Covishield can, in very rare cases, cause TTS.” TTS stands for Thrombosis with Thrombocytopenia Syndrome.

Dr. Rajeev Jayadevan, a medical expert, told ANI,

“TTS is thrombosis with thrombocytopenia syndrome, which is basically a clot in the blood vessels of the brain or elsewhere, along with a low platelet count. It is known to occur in very rare instances following certain types of vaccines and also from other causes. According to the WHO, adenovirus vector vaccines, in particular, have rarely been associated with this condition.”

TTS: About, Diagnosis, Treatment TTS, or Thrombosis with Thrombocytopenia Syndrome, is a serious yet rare health condition characterized by low platelet counts (thrombocytopenia) along with the formation of blood clots (thrombosis).

Various symptoms associated with TTS include neurological deficits, shortness of breath, leg swelling, abdominal pain, and severe headaches.

TTS can be diagnosed if blood tests are conducted to assess the levels of platelets in the blood. Moreover, to detect blood clots, imaging studies are required, reported the Times of India .

TTS can be treated with a multidisciplinary approach. It includes supportive care, anticoagulation therapy to prevent blood clotting, and hospitalization.

To manage and stabilize platelet levels in the body, plasma exchange and intravenous immunoglobulin (IVIG) can also be performed.

Patients with TTS are prone to severe complications like death and organ damage. Hence, close monitoring of patients by healthcare providers is a must.

Also Read: Online doctor consultations in India increase by 4 times after the Covid-19 pandemic: Report

Report: Gangster Goldy Brar Is Alive, Confirms US Police Published

6 days ago on

May 2, 2024 The prime suspect in the murder case of a famous Punjabi singer, Goldy Brar, is alive, reported TOI .

Goldy is the infamous Canadian gangster who was earlier rumored to be dead in an alleged incident that took place at Fairmont and Holt Avenue last Tuesday.

In the incident, one of the two individuals reportedly got gunshot wound and succumbed to injuries at the hospital. You can read our story about California shooting incident in which Goldy Brar allegedly got shot here .

As per the US police, reports of Goldy’s disappearance were circulating all over the internet on Tuesday. However, the U.S. authorities clarified the rumors of Brar’s disappearance in a California shooting incident are untrue.

The claims were refuted by the Fresno police department and labeled them as fake. William J. Dooley, the Lieutenant, debunked online speculations and announced that the victim of the California shooting was not Goldy Brar.

William J. Dooley stated,

“If you are inquiring because of the online chatter claiming that the shooting victim is ‘Goldy Brar’, we can confirm that this is absolutely not true.”

Who is Goldy Brar? Goldy Brar, hailing from Muktsar Sahib, Punjab, is a close ally of gangster Lawrence Bishnoi. It is anticipated that he is the mastermind behind the assassination of Sidhu Moose Wala, the Punjabi pop icon.

According to The Economic Times , in January 2024, Satinderjit Singh, also known as Goldy Brar, was designated as a terrorist by the Ministry of Home Affairs under the anti-terror law, UAPA (Unlawful Activities (Prevention) Act).

Orders by the government-linked Goldy Brar to a listed terrorist organization under the UAPA, Babbar Khalsa International.

Goldy Brar has never ceased to vanish from police’s eyes since he murdered Punjabi singer Sidhu Moosewala. His father also was a Police Officer himself.

After completing his graduation and getting a BS degree, he has been operating from Canada remotely.

Last year Goldy’s statement, targetting Bollywood superstar Salman Khan next made huge media headlines.

(adsbygoogle = window.adsbygoogle || []).push({});

(adsbygoogle = window.adsbygoogle || []).push({});

(adsbygoogle = window.adsbygoogle || []).push({});

(adsbygoogle = window.adsbygoogle || []).push({});

(adsbygoogle = window.adsbygoogle || []).push({});

(adsbygoogle = window.adsbygoogle || []).push({});

(adsbygoogle = window.adsbygoogle || []).push({});

(adsbygoogle = window.adsbygoogle || []).push({});

(adsbygoogle = window.adsbygoogle || []).push({});

(adsbygoogle = window.adsbygoogle || []).push({});

(adsbygoogle = window.adsbygoogle || []).push({});

(adsbygoogle = window.adsbygoogle || []).push({});

(adsbygoogle = window.adsbygoogle || []).push({});

(adsbygoogle = window.adsbygoogle || []).push({});

if (window.innerWidth < 768) { jQuery(document).find('.ays-pb-modal_2').css({'top': '0', 'right': '0', 'bottom': '0', 'left': '0'}); } else { jQuery(document).find('.ays-pb-modal_2').css({'top': '0', 'right': '0', 'bottom': '0', 'left': '0'}); }

(function( $ ) {

'use strict';

$(document).ready(function(){

let pbViewsFlag_2 = true;

if ('image_type_img_theme' == 'notification') {

$(document).find('.ays-pb-modals').prependTo($(document.body));

} else {

$(document).find('.ays-pb-modals:not(.ays-pb-modals.ays-pb-notification-modal)').appendTo($(document.body));

}

let isMobile = false;

let closePopupOverlay = 1;

let isPageScrollDisabled = 0;

let checkAnimSpeed = 1;

let ays_pb_animation_close_speed = $(document).find('#ays_pb_animation_close_speed_2').val();

let ays_pb_effectIn_2 = $(document).find('#ays_pb_modal_animate_in_2').val();

let ays_pb_effectOut_2 = $(document).find('#ays_pb_modal_animate_out_2').val();

if (window.innerWidth < 768) {

isMobile = true;

closePopupOverlay = 1;

isPageScrollDisabled = 0;

checkAnimSpeed = 1;

ays_pb_animation_close_speed = $(document).find('#ays_pb_animation_close_speed_mobile_2').val();

ays_pb_effectIn_2 = $(document).find('#ays_pb_modal_animate_in_mobile_2').val();

ays_pb_effectOut_2 = $(document).find('#ays_pb_modal_animate_out_mobile_2').val();

}

let ays_pb_delayOpen_2 = parseInt($(document).find('.ays_pb_delay_2').val());

let ays_pb_scrollTop_2 = parseInt($(document).find('.ays_pb_scroll_2').val());

if (isMobile) {

if (0) {

ays_pb_scrollTop_2= parseInt($(document).find('.ays_pb_scroll_mobile_2').val());

}if (0) {

ays_pb_delayOpen_2 = parseInt($(document).find('.ays_pb_delay_mobile_2').val());

}

}

let time_pb_2 = $(document).find('.ays_pb_timer_2 span').data('seconds'),

ays_pb_animation_close_seconds = (ays_pb_animation_close_speed / 1000);

if( ays_pb_delayOpen_2 == 0 && ays_pb_scrollTop_2 == 0){

$(document).find('.av_pop_modals_2').css('display','block');

}if (window.innerWidth < 768) {

var mobileTimer = +$(document).find('.ays_pb_timer_2 span').attr('data-ays-mobile-seconds');

$(document).find('.ays_pb_timer_2 span').html(mobileTimer);

time_pb_2 = mobileTimer;

}ays_pb_animation_close_speed = parseFloat(ays_pb_animation_close_speed) - 50;$(document).find('.ays_music_sound').css({'display':'none'});

if(time_pb_2 !== undefined){

if(time_pb_2 !== 0){

$(document).find('#ays-pb-modal-checkbox_2').trigger('click');

if(ays_pb_scrollTop_2 == 0){

var ays_pb_flag = true;

$(document).find('.ays-pb-modal_2').css({

'animation-duration': ays_pb_animation_close_seconds + 's'

});

let timer_pb_2 = setInterval(function(){

let newTime_pb_2 = time_pb_2--;

$(document).find('.ays_pb_timer_2 span').text(newTime_pb_2);

if(newTime_pb_2 <= 0){

$(document).find('.ays-pb-modal-close_2').trigger('click');

$(document).find('.ays-pb-modal_2').attr('class', 'ays-pb-modal ays-pb-modal-image-type-img ays-pb-modal_2 ays-pb-border-mobile_2 '+ays_pb_effectOut_2);

if(ays_pb_effectOut_2 != 'none'){

setTimeout(function(){

$(document).find('.ays-pb-modal_2').css('display', 'none');

$(document).find('.ays-pb-modal_2').attr('data-ays-flag','true');

}, ays_pb_animation_close_speed);

}else{

$(document).find('.ays-pb-modal_2').css('display', 'none');

$(document).find('.ays-pb-modal_2').attr('data-ays-flag','true');

}

clearInterval(timer_pb_2);

}

$(document).find('.ays-pb-modal-close_2').one('click', function(){

if (pbViewsFlag_2) {

var pb_id = 2;$.ajax({

url: pbLocalizeObj.ajax,

method: 'POST',

dataType: 'text',

data: {

id: pb_id,

action: 'ays_increment_pb_views',

},

});pbViewsFlag_2 = false;

}

$(document).find('.av_pop_modals_2').css('pointer-events', 'none');

$(document).find('.ays-pb-modal_2').attr('class', 'ays-pb-modal ays-pb-modal-image-type-img ays-pb-modal_2 ays-pb-border-mobile_2 '+ays_pb_effectOut_2);

$(this).parents('.ays-pb-modals').find('iframe').each(function(){

var key = /https:\/\/www.youtube.com/;

var src = $(this).attr('src');

$(this).attr('src', $(this).attr('src'));

});

$(this).parents('.ays-pb-modals').find('video.wp-video-shortcode').each(function(){

if(typeof $(this).get(0) != 'undefined'){

if ( ! $(this).get(0).paused ) {

$(this).get(0).pause();

}

}

});

$(this).parents('.ays-pb-modals').find('audio.wp-audio-shortcode').each(function(){

if(typeof $(this).get(0) != 'undefined'){

if ( ! $(this).get(0).paused ) {

$(this).get(0).pause();

}

}

});

var close_sound_src = $(document).find('#ays_pb_close_sound_2').attr('src');

if(checkAnimSpeed && typeof close_sound_src !== 'undefined' && 'off' === 'on'){

if(checkAnimSpeed !== 0){

var playPromise = $(document).find('#ays_pb_close_sound_2').get(0).play();

if (playPromise !== undefined) {

playPromise.then(function() {

audio.pause();

}).catch(function(error) {

});

}

}

}

if(ays_pb_effectOut_2 != 'none'){

setTimeout(function(){

$(document).find('.ays-pb-modal_2').css('display', 'none');

$(document).find('.av_pop_modals_2').css('display', 'none');

$(document).find('.ays-pb-modal_2').attr('data-ays-flag','true');

if($('#ays_pb_close_sound_2').get(0) != undefined){

if(!$('#ays_pb_close_sound_2').get(0).paused){

$(document).find('.ays-pb-modal_2').css('display', 'none');

var audio = $('#ays_pb_close_sound_2').get(0);

audio.pause();

audio.currentTime = 0;

}

}

}, ays_pb_animation_close_speed);

}else{

$(document).find('.ays-pb-modal_2').css('display', 'none');

$(document).find('.av_pop_modals_2').css('display', 'none');

$(document).find('.ays-pb-modal_2').attr('data-ays-flag','true');

if($('#ays_pb_close_sound_2').get(0) != undefined){

if(!$('#ays_pb_close_sound_2').get(0).paused){

$(document).find('.ays-pb-modal_2').css('display', 'none');

var audio = $('#ays_pb_close_sound_2').get(0);

audio.pause();

audio.currentTime = 0;

}

}

}

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0', 'display': 'none'});

clearInterval(timer_pb_2);

});

$(document).on('keydown', function(event) {

if('1' && ays_pb_flag){

var escClosingPopups = $(document).find('.ays-pb-close-popup-with-esc:visible');

if (event.keyCode == 27) {

var topmostPopup = escClosingPopups.last();

topmostPopup.find('.ays-pb-modal-close_2').trigger('click');

}

} else {

ays_pb_flag = true;

}

ays_pb_flag = false;

});

},1000);

if(closePopupOverlay && 'On' == 'On'){

$(document).find('.av_pop_modals_2').on('click', function(e) {

var pb_parent = $(this);

var pb_div = $(this).find('.ays-pb-modal_2');

if (!pb_div.is(e.target) && pb_div.has(e.target).length === 0){

$(document).find('.ays-pb-modal-close_2').click();

}

});

}

}

} else {

$(document).find('.ays_pb_timer_2').css('display','none');

$(document).find('.ays-pb-modal_2').css({

'animation-duration': ays_pb_animation_close_seconds + 's'

});

$(document).find('.ays-pb-modal-close_2').one('click', function(){

if (pbViewsFlag_2) {

var pb_id = 2;$.ajax({

url: pbLocalizeObj.ajax,

method: 'POST',

dataType: 'text',

data: {

id: pb_id,

action: 'ays_increment_pb_views',

},

});pbViewsFlag_2 = false;

}

$(document).find('.av_pop_modals_2').css('pointer-events', 'none');

$(document).find('.ays-pb-modal_2').attr('class', 'ays-pb-modal ays-pb-modal-image-type-img ays-pb-modal_2 ays-pb-border-mobile_2 '+ays_pb_effectOut_2);

$(this).parents('.ays-pb-modals').find('iframe').each(function(){

var key = /https:\/\/www.youtube.com/;

var src = $(this).attr('src');

$(this).attr('src', $(this).attr('src'));

});

$(this).parents('.ays-pb-modals').find('video.wp-video-shortcode').each(function(){

if(typeof $(this).get(0) != 'undefined'){

if ( ! $(this).get(0).paused ) {

$(this).get(0).pause();

}

}

});

$(this).parents('.ays-pb-modals').find('audio.wp-audio-shortcode').each(function(){

if(typeof $(this).get(0) != 'undefined'){

if ( ! $(this).get(0).paused ) {

$(this).get(0).pause();

}

}

});

if(ays_pb_effectOut_2 != 'none'){

setTimeout(function(){

$(document).find('.ays-pb-modal_2').css('display', 'none');

$(document).find('.av_pop_modals_2').css('display', 'none');

$(document).find('.ays-pb-modal_2').attr('data-ays-flag','true');

if($('#ays_pb_close_sound_2').get(0) != undefined){

if(!$('#ays_pb_close_sound_2').get(0).paused){

$(document).find('.ays-pb-modal_2').css('display', 'none');

var audio = $('#ays_pb_close_sound_2').get(0);

audio.pause();

audio.currentTime = 0;

}

}

}, ays_pb_animation_close_speed);

}else{

$(document).find('.ays-pb-modal_2').css('display', 'none');

$(document).find('.av_pop_modals_2').css('display', 'none');

$(document).find('.ays-pb-modal_2').attr('data-ays-flag','true');

if($('#ays_pb_close_sound_2').get(0) != undefined){

if(!$('#ays_pb_close_sound_2').get(0).paused){

$(document).find('.ays-pb-modal_2').css('display', 'none');

var audio = $('#ays_pb_close_sound_2').get(0);

audio.pause();

audio.currentTime = 0;

}

}

}

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0', 'display': 'none'});

});

}

}

let count = 0;

if( ays_pb_scrollTop_2 !== 0 ){

$(window).scroll(function() {

if(($(this).scrollTop() >= ays_pb_scrollTop_2) && (count === 0)) {

count++;

if( ays_pb_delayOpen_2 !== 0 ){

$(document).find('.ays-pb-modal_2').css('animation-delay', ays_pb_delayOpen_2/1000);

setTimeout(function(){

$(document).find('.av_pop_modals_2').css('display','block');

$(document).find('.ays-pb-modal_2').addClass(ays_pb_effectIn_2);

$(document).find('.ays-pb-modal_2').css('display', 'block');

if (window.innerWidth < 768 && $(document).find('#ays-pb-screen-shade_2').attr('data-mobile-overlay') == 'true') {

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0.5'});

}

else{

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0.500000'});

}$(document).find('.ays-pb-modal-check_2').prop('checked', true);

}, ays_pb_delayOpen_2);

}else{

$(document).find('.av_pop_modals_2').css('display','block');

$(document).find('.ays-pb-modal_2').addClass(ays_pb_effectIn_2);

$(document).find('.ays-pb-modal_2').css('display', 'block');

if (window.innerWidth < 768 && $(document).find('#ays-pb-screen-shade_2').attr('data-mobile-overlay') == 'true') {

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0.5'});

}

else{

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0.500000'});

}$(document).find('.ays-pb-modal-check_2').prop('checked', true);

}

if('false' == 'true' && window.innerWidth < 768){

if(0 != 0 && 'off' != 'on'){

let close_button_delay_for_mobile = 0;

if (ays_pb_delayOpen_2 != 0) {

close_button_delay_for_mobile += Math.floor(ays_pb_delayOpen_2);

}

$(document).find('.ays-pb-modal-close_2').css({'display': 'none'});

setTimeout(function(){

$(document).find('.ays-pb-modal-close_2').css({'display': 'block'});

}, close_button_delay_for_mobile );

}

}

else {

if(0 != 0 && 'off' != 'on'){

let close_button_delay = 0;

if (ays_pb_delayOpen_2 != 0) {

close_button_delay += Math.floor(ays_pb_delayOpen_2);

}

$(document).find('.ays-pb-modal-close_2').css({'display': 'none'});

setTimeout(function(){

$(document).find('.ays-pb-modal-close_2').css({'display': 'block'});

}, close_button_delay );

}

}

if(5 != 0){

$(document).find('.ays-pb-modal_2').css({

'animation-duration': ays_pb_animation_close_seconds + 's'

});

let timer_pb_2 = setInterval(function(){

let newTime_pb_2 = time_pb_2--;

$(document).find('.ays_pb_timer_2 span').text(newTime_pb_2);

if(newTime_pb_2 <= 0){

$(document).find('.ays-pb-modal-close_2').trigger('click');

$(document).find('.ays-pb-modal_2').attr('class', 'ays-pb-modal ays-pb-modal-image-type-img ays-pb-modal_2 '+ays_pb_effectOut_2);

if(ays_pb_effectOut_2 != 'none'){

setTimeout(function(){

$(document).find('.ays-pb-modal_2').css('display', 'none');

$(document).find('.ays-pb-modal_2').attr('data-ays-flag','true');

}, ays_pb_animation_close_speed);

}else{

$(document).find('.ays-pb-modal_2').css('display', 'none');

$(document).find('.ays-pb-modal_2').attr('data-ays-flag','true');

}

clearInterval(timer_pb_2);

}

$(document).find('.ays-pb-modal-close_2').one('click', function(){

if (pbViewsFlag_2) {

var pb_id = 2;$.ajax({

url: pbLocalizeObj.ajax,

method: 'POST',

dataType: 'text',

data: {

id: pb_id,

action: 'ays_increment_pb_views',

},

});pbViewsFlag_2 = false;

}

$(document).find('.av_pop_modals_2').css('pointer-events', 'none');

$(document).find('.ays-pb-modal_2').attr('class', 'ays-pb-modal ays-pb-modal-image-type-img ays-pb-modal_2 ays-pb-border-mobile_2 '+ays_pb_effectOut_2);

$(this).parents('.ays-pb-modals').find('iframe').each(function(){

var key = /https:\/\/www.youtube.com/;

var src = $(this).attr('src');

$(this).attr('src', $(this).attr('src'));

});

$(this).parents('.ays-pb-modals').find('video.wp-video-shortcode').each(function(){

if(typeof $(this).get(0) != 'undefined'){

if ( ! $(this).get(0).paused ) {

$(this).get(0).pause();

}

}

});

$(this).parents('.ays-pb-modals').find('audio.wp-audio-shortcode').each(function(){

if(typeof $(this).get(0) != 'undefined'){

if ( ! $(this).get(0).paused ) {

$(this).get(0).pause();

}

}

});

if(ays_pb_effectOut_2 != 'none'){

setTimeout(function(){

$(document).find('.ays-pb-modal_2').css('display', 'none');

$(document).find('.av_pop_modals_2').css('display', 'none');

$(document).find('.ays-pb-modal_2').attr('data-ays-flag','true');

if($('#ays_pb_close_sound_2').get(0) != undefined){

if(!$('#ays_pb_close_sound_2').get(0).paused){

$(document).find('.ays-pb-modal_2').css('display', 'none');

var audio = $('#ays_pb_close_sound_2').get(0);

audio.pause();

audio.currentTime = 0;

}

}

}, ays_pb_animation_close_speed);

}else{

$(document).find('.ays-pb-modal_2').css('display', 'none');

$(document).find('.av_pop_modals_2').css('display', 'none');

$(document).find('.ays-pb-modal_2').attr('data-ays-flag','true');

if($('#ays_pb_close_sound_2').get(0) != undefined){

if(!$('#ays_pb_close_sound_2').get(0).paused){

$(document).find('.ays-pb-modal_2').css('display', 'none');

var audio = $('#ays_pb_close_sound_2').get(0);

audio.pause();

audio.currentTime = 0;

}

}

}

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0', 'display': 'none'});

clearInterval(timer_pb_2);

});

var ays_pb_flag = true;

$(document).on('keydown', function(event) {

if('1' && ays_pb_flag){

var escClosingPopups = $(document).find('.ays-pb-close-popup-with-esc:visible');

if (event.keyCode == 27) {

var topmostPopup = escClosingPopups.last();

topmostPopup.find('.ays-pb-modal-close_2').trigger('click');

ays_pb_flag = false;

}

} else {

ays_pb_flag = true;

}

});

},1000);

}

}

});

}else{

if( ays_pb_delayOpen_2 !== 0 ){

$(document).find('.ays-pb-modal_2').css('animation-delay', ays_pb_delayOpen_2/1000);

setTimeout(function(){

$(document).find('.av_pop_modals_2').css('display','block');

$(document).find('.ays-pb-modal_2').addClass(ays_pb_effectIn_2);

$(document).find('.ays-pb-modal_2').css('display', 'block');

if (window.innerWidth < 768 && $(document).find('#ays-pb-screen-shade_2').attr('data-mobile-overlay') == 'true') {

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0.5'});

}

else{

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0.500000'});

}

$(document).find('.ays-pb-modal-check_2').attr('checked', 'checked');if(isPageScrollDisabled){

$(document).find('body').addClass('pb_disable_scroll_2');

$(document).find('html').removeClass('pb_enable_scroll');

}}, ays_pb_delayOpen_2);

} else {

if($(document).find('.ays_pb_abt_2').val() != 'clickSelector'){

$(document).find('.av_pop_modals_2').css('display','block');

$(document).find('.ays-pb-modal_2').addClass(ays_pb_effectIn_2);

$(document).find('.ays-pb-modal_2').css('display', 'block');

if (window.innerWidth < 768 && $(document).find('#ays-pb-screen-shade_2').attr('data-mobile-overlay') == 'true') {

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0.5'});

}

else{

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0.500000'});

}

$(document).find('.ays-pb-modal-check_2').attr('checked', 'checked');if(isPageScrollDisabled){

$(document).find('body').addClass('pb_disable_scroll_2');

$(document).find('html').addClass('pb_disable_scroll_2');

}

}

}

}

if ('On' != 'On'){

$(document).find('#ays-pb-screen-shade_2').css({'opacity': '0', 'display': 'none !important', 'pointer-events': 'none', 'background': 'none'});

$(document).find('.ays-pb-modal_2').css('pointer-events', 'auto');

$(document).find('.av_pop_modals_2').css('pointer-events','none');

};

if($(document).find('.ays-pb-modals video').hasClass('wp-video-shortcode')){

var videoWidth = $(document).find('.ays-pb-modals video.wp-video-shortcode').attr('width');

var videoHeight = $(document).find('.ays-pb-modals video.wp-video-shortcode').attr('height');

setTimeout(function(){

$(document).find('.ays-pb-modals .wp-video').removeAttr('style');

$(document).find('.ays-pb-modals .mejs-container').removeAttr('style');

$(document).find('.ays-pb-modals video.wp-video-shortcode').removeAttr('style');$(document).find('.ays-pb-modals .wp-video').css({'width': '100%'});

$(document).find('.ays-pb-modals .mejs-container').css({'width': '100%','height': videoHeight + 'px'});

$(document).find('.ays-pb-modals video.wp-video-shortcode').css({'width': '100%','height': videoHeight + 'px'});

},1000);

}

if($(document).find('.ays-pb-modals iframe').attr('style') != ''){

setTimeout(function(){

$(document).find('.ays-pb-modals iframe').removeAttr('style');

},500);

}

// if(5 == 0){

if(closePopupOverlay && 'On' == 'On'){

$(document).find('.av_pop_modals_2').on('click', function(e) {

var pb_parent = $(this);

var pb_div = $(this).find('.ays-pb-modal_2');

if (!pb_div.is(e.target) && pb_div.has(e.target).length === 0){

$(document).find('.ays-pb-modal-close_2').click();

}

});

}

var ays_pb_flag = true;

$(document).on('keydown', function(event) {

if('1' && ays_pb_flag){

var escClosingPopups = $(document).find('.ays-pb-close-popup-with-esc:visible');

if (event.keyCode == 27) {

var topmostPopup = escClosingPopups.last();

topmostPopup.find('.ays-pb-modal-close_2').trigger('click');

ays_pb_flag = false;

}

} else {

ays_pb_flag = true;

}

});

// }

if('off' == 'on') {

var video = $(document).find('video.wp-video-shortcode');

for (let i = 0; i < video.length; i++) {

video[i].addEventListener('ended', function() {

if ($(this).next().val() === 'on') {

$(this).parents('.ays_video_window').find('.close-image-btn').trigger('click');

}

});

}

}

jQuery(document).on('click', '.ays-pb-modal-close_2', function() {

$(document).find('body').removeClass('pb_disable_scroll_2');

$(document).find('html').removeClass('pb_disable_scroll_2');

});});

})( jQuery );

if(typeof aysPopupOptions === "undefined"){

var aysPopupOptions = [];

}

aysPopupOptions["2"] = "eyJwb3B1cGJveCI6eyJpZCI6IjIiLCJ0aXRsZSI6IkFkIiwicG9wdXBfbmFtZSI6IiIsImRlc2NyaXB0aW9uIjoiRGVtbyBEZXNjcmlwdGlvbiIsImNhdGVnb3J5X2lkIjoiMSIsImF1dG9jbG9zZSI6IjUiLCJjb29raWUiOiIxNDQwIiwid2lkdGgiOjQwMCwiaGVpZ2h0Ijo1MDAsImJnY29sb3IiOiIjZmZmZmZmIiwidGV4dGNvbG9yIjoiIzAwMDAwMCIsImJvcmRlcnNpemUiOiIxIiwiYm9yZGVyY29sb3IiOiIjZmZmZmZmIiwiYm9yZGVyX3JhZGl1cyI6IjQiLCJzaG9ydGNvZGUiOiIiLCJ1c2Vyc19yb2xlIjoiW10iLCJjdXN0b21fY2xhc3MiOiIiLCJjdXN0b21fY3NzIjoiIiwiY3VzdG9tX2h0bWwiOiJIZXJlIGNhbiBiZSB5b3VyIGN1c3RvbSBIVE1MIG9yIFNob3J0Y29kZSIsIm9ub2Zmc3dpdGNoIjoiT24iLCJzaG93X29ubHlfZm9yX2F1dGhvciI6Im9mZiIsInNob3dfYWxsIjoiYWxsIiwiZGVsYXkiOiIzIiwic2Nyb2xsX3RvcCI6IjAiLCJhbmltYXRlX2luIjoiZmFkZUluIiwiYW5pbWF0ZV9vdXQiOiJmYWRlT3V0IiwiYWN0aW9uX2J1dHRvbiI6IiIsInZpZXdfcGxhY2UiOiIiLCJhY3Rpb25fYnV0dG9uX3R5cGUiOiJwYWdlTG9hZGVkIiwibW9kYWxfY29udGVudCI6ImltYWdlX3R5cGUiLCJ2aWV3X3R5cGUiOiJpbWFnZV90eXBlX2ltZ190aGVtZSIsIm9ub2Zmb3ZlcmxheSI6Ik9uIiwib3ZlcmxheV9vcGFjaXR5IjoiMC41MDAwMDAiLCJzaG93X3BvcHVwX3RpdGxlIjoiT2ZmIiwic2hvd19wb3B1cF9kZXNjIjoiT2ZmIiwiY2xvc2VfYnV0dG9uIjoib2ZmIiwiaGVhZGVyX2JnY29sb3IiOiIjZmZmZmZmIiwiYmdfaW1hZ2UiOiIiLCJsb2dfdXNlciI6Ik9uIiwiZ3Vlc3QiOiJPbiIsImFjdGl2ZV9kYXRlX2NoZWNrIjoib2ZmIiwiYWN0aXZlSW50ZXJ2YWwiOiIyMDI0LTA0LTE5IDE2OjA0OjE3IiwiZGVhY3RpdmVJbnRlcnZhbCI6IjIwMjQtMDQtMTkgMTY6MDQ6MTciLCJwYl9wb3NpdGlvbiI6ImNlbnRlci1jZW50ZXIiLCJwYl9tYXJnaW4iOiIwIiwidmlld3MiOiI3Njc0NyIsImNvbnZlcnNpb25zIjoiMCIsIm9wdGlvbnMiOiJ7XCJlbmFibGVfYmFja2dyb3VuZF9ncmFkaWVudFwiOlwib2ZmXCIsXCJiYWNrZ3JvdW5kX2dyYWRpZW50X2NvbG9yXzFcIjpcIiMwMDBcIixcImJhY2tncm91bmRfZ3JhZGllbnRfY29sb3JfMlwiOlwiI2ZmZlwiLFwicGJfZ3JhZGllbnRfZGlyZWN0aW9uXCI6XCJ2ZXJ0aWNhbFwiLFwiZW5hYmxlX2JhY2tncm91bmRfZ3JhZGllbnRfbW9iaWxlXCI6XCJvZmZcIixcImJhY2tncm91bmRfZ3JhZGllbnRfY29sb3JfMV9tb2JpbGVcIjpcIiMwMDBcIixcImJhY2tncm91bmRfZ3JhZGllbnRfY29sb3JfMl9tb2JpbGVcIjpcIiNmZmZcIixcInBiX2dyYWRpZW50X2RpcmVjdGlvbl9tb2JpbGVcIjpcInZlcnRpY2FsXCIsXCJleGNlcHRfcG9zdF90eXBlc1wiOltdLFwiZXhjZXB0X3Bvc3RzXCI6W10sXCJhbGxfcG9zdHNcIjpcIlwiLFwiY2xvc2VfYnV0dG9uX2RlbGF5XCI6MCxcImNsb3NlX2J1dHRvbl9kZWxheV9mb3JfbW9iaWxlXCI6MCxcImVuYWJsZV9jbG9zZV9idXR0b25fZGVsYXlfZm9yX21vYmlsZVwiOlwib2ZmXCIsXCJlbmFibGVfcGJfc291bmRcIjpcIm9mZlwiLFwib3ZlcmxheV9jb2xvclwiOlwiIzAwMFwiLFwiZW5hYmxlX292ZXJsYXlfY29sb3JfbW9iaWxlXCI6XCJvZmZcIixcIm92ZXJsYXlfY29sb3JfbW9iaWxlXCI6XCIjMDAwXCIsXCJhbmltYXRpb25fc3BlZWRcIjoxLFwiZW5hYmxlX2FuaW1hdGlvbl9zcGVlZF9tb2JpbGVcIjpcIm9mZlwiLFwiYW5pbWF0aW9uX3NwZWVkX21vYmlsZVwiOjEsXCJjbG9zZV9hbmltYXRpb25fc3BlZWRcIjoxLFwiZW5hYmxlX2Nsb3NlX2FuaW1hdGlvbl9zcGVlZF9tb2JpbGVcIjpcIm9mZlwiLFwiY2xvc2VfYW5pbWF0aW9uX3NwZWVkX21vYmlsZVwiOjEsXCJwYl9tb2JpbGVcIjpcIm9mZlwiLFwiY2xvc2VfYnV0dG9uX3RleHRcIjpcIlxcdTI3MTVcIixcImVuYWJsZV9jbG9zZV9idXR0b25fdGV4dF9tb2JpbGVcIjpcIm9uXCIsXCJjbG9zZV9idXR0b25fdGV4dF9tb2JpbGVcIjpcIlxcdTI3MTVcIixcImNsb3NlX2J1dHRvbl9ob3Zlcl90ZXh0XCI6XCJcIixcIm1vYmlsZV93aWR0aFwiOlwiXCIsXCJtb2JpbGVfbWF4X3dpZHRoXCI6XCJcIixcIm1vYmlsZV9oZWlnaHRcIjpcIlwiLFwiY2xvc2VfYnV0dG9uX3Bvc2l0aW9uXCI6XCJyaWdodC10b3BcIixcImVuYWJsZV9jbG9zZV9idXR0b25fcG9zaXRpb25fbW9iaWxlXCI6XCJvZmZcIixcImNsb3NlX2J1dHRvbl9wb3NpdGlvbl9tb2JpbGVcIjpcInJpZ2h0LXRvcFwiLFwic2hvd19vbmx5X29uY2VcIjpcIm9mZlwiLFwic2hvd19vbl9ob21lX3BhZ2VcIjpcIm9mZlwiLFwiY2xvc2VfcG9wdXBfZXNjXCI6XCJvblwiLFwicG9wdXBfd2lkdGhfYnlfcGVyY2VudGFnZV9weFwiOlwicGl4ZWxzXCIsXCJwb3B1cF9jb250ZW50X3BhZGRpbmdcIjowLFwicG9wdXBfcGFkZGluZ19ieV9wZXJjZW50YWdlX3B4XCI6XCJwaXhlbHNcIixcInBiX2ZvbnRfZmFtaWx5XCI6XCJpbmhlcml0XCIsXCJjbG9zZV9wb3B1cF9vdmVybGF5XCI6XCJvblwiLFwiY2xvc2VfcG9wdXBfb3ZlcmxheV9tb2JpbGVcIjpcIm9uXCIsXCJlbmFibGVfcGJfZnVsbHNjcmVlblwiOlwib2ZmXCIsXCJlbmFibGVfaGlkZV90aW1lclwiOlwib2ZmXCIsXCJlbmFibGVfaGlkZV90aW1lcl9tb2JpbGVcIjpcIm9mZlwiLFwiZW5hYmxlX2F1dG9jbG9zZV9vbl9jb21wbGV0aW9uXCI6XCJvZmZcIixcImVuYWJsZV9zb2NpYWxfbGlua3NcIjpcIm9mZlwiLFwic29jaWFsX2xpbmtzXCI6e1wibGlua2VkaW5fbGlua1wiOlwiXCIsXCJmYWNlYm9va19saW5rXCI6XCJcIixcInR3aXR0ZXJfbGlua1wiOlwiXCIsXCJ2a29udGFrdGVfbGlua1wiOlwiXCIsXCJ5b3V0dWJlX2xpbmtcIjpcIlwiLFwiaW5zdGFncmFtX2xpbmtcIjpcIlwiLFwiYmVoYW5jZV9saW5rXCI6XCJcIn0sXCJzb2NpYWxfYnV0dG9uc19oZWFkaW5nXCI6XCJcIixcImNsb3NlX2J1dHRvbl9zaXplXCI6MSxcImNsb3NlX2J1dHRvbl9pbWFnZVwiOlwiXCIsXCJib3JkZXJfc3R5bGVcIjpcInNvbGlkXCIsXCJlbmFibGVfYm9yZGVyX3N0eWxlX21vYmlsZVwiOlwib2ZmXCIsXCJib3JkZXJfc3R5bGVfbW9iaWxlXCI6XCJzb2xpZFwiLFwiYXlzX3BiX2hvdmVyX3Nob3dfY2xvc2VfYnRuXCI6XCJvZmZcIixcImRpc2FibGVfc2Nyb2xsXCI6XCJvZmZcIixcImRpc2FibGVfc2Nyb2xsX21vYmlsZVwiOlwib2ZmXCIsXCJlbmFibGVfb3Blbl9kZWxheV9tb2JpbGVcIjpcIm9mZlwiLFwib3Blbl9kZWxheV9tb2JpbGVcIjpcIjBcIixcImVuYWJsZV9zY3JvbGxfdG9wX21vYmlsZVwiOlwib2ZmXCIsXCJzY3JvbGxfdG9wX21vYmlsZVwiOlwiMFwiLFwiZW5hYmxlX3BiX3Bvc2l0aW9uX21vYmlsZVwiOlwib2ZmXCIsXCJwYl9wb3NpdGlvbl9tb2JpbGVcIjpcImNlbnRlci1jZW50ZXJcIixcInBiX2JnX2ltYWdlX3Bvc2l0aW9uXCI6XCJjZW50ZXItY2VudGVyXCIsXCJlbmFibGVfcGJfYmdfaW1hZ2VfcG9zaXRpb25fbW9iaWxlXCI6XCJvZmZcIixcInBiX2JnX2ltYWdlX3Bvc2l0aW9uX21vYmlsZVwiOlwiY2VudGVyLWNlbnRlclwiLFwicGJfYmdfaW1hZ2Vfc2l6aW5nXCI6XCJjb3ZlclwiLFwiZW5hYmxlX3BiX2JnX2ltYWdlX3NpemluZ19tb2JpbGVcIjpcIm9mZlwiLFwicGJfYmdfaW1hZ2Vfc2l6aW5nX21vYmlsZVwiOlwiY292ZXJcIixcInZpZGVvX3RoZW1lX3VybFwiOlwiXCIsXCJpbWFnZV90eXBlX2ltZ19zcmNcIjpcImh0dHBzOlxcXC9cXFwvd3d3LnVuaXF1ZW5ld3NvbmxpbmUuY29tXFxcL3dwLWNvbnRlbnRcXFwvdXBsb2Fkc1xcXC8yMDI0XFxcLzA0XFxcL2Jhbm5lci1zYXRzc3BvcnRzLmpwZ1wiLFwiaW1hZ2VfdHlwZV9pbWdfcmVkaXJlY3RfdXJsXCI6XCJodHRwczpcXFwvXFxcL3d3dy5zYXRzcG9ydC5jb21cXFwveFxcXC8jXFxcLzJcXFwvaG9tZVxcXC9leGNoYW5nZVxcXC9zcG9ydFxcXC9hbGw/c2lnbnVwPXRydWUmdXRtX3NvdXJjZT11bmlxdWVuZXdzb25saW5lJnV0bV9tZWRpdW09dW5pcXVlbmV3c29ubGluZVwiLFwiZmFjZWJvb2tfcGFnZV91cmxcIjpcImh0dHBzOlxcXC9cXFwvd3d3LmZhY2Vib29rLmNvbVxcXC93b3JkcHJlc3NcIixcImhpZGVfZmJfcGFnZV9jb3Zlcl9waG90b1wiOlwib2ZmXCIsXCJub3RpZmljYXRpb25fdHlwZV9jb21wb25lbnRzXCI6W10sXCJub3RpZmljYXRpb25fdHlwZV9jb21wb25lbnRzX29yZGVyXCI6e1wibWFpbl9jb250ZW50XCI6XCJtYWluX2NvbnRlbnRcIixcImJ1dHRvbl8xXCI6XCJidXR0b25fMVwifSxcIm5vdGlmaWNhdGlvbl9tYWluX2NvbnRlbnRcIjpcIldyaXRlIHRoZSBjdXN0b20gbm90aWZpY2F0aW9uIGJhbm5lciB0ZXh0IGhlcmUuXCIsXCJub3RpZmljYXRpb25fYnV0dG9uXzFfdGV4dFwiOlwiQ2xpY2shXCIsXCJub3RpZmljYXRpb25fYnV0dG9uXzFfcmVkaXJlY3RfdXJsXCI6XCJcIixcInBiX21heF9oZWlnaHRcIjpcIlwiLFwicG9wdXBfbWF4X2hlaWdodF9ieV9wZXJjZW50YWdlX3B4XCI6XCJwaXhlbHNcIixcInBiX21heF9oZWlnaHRfbW9iaWxlXCI6XCJcIixcInBvcHVwX21heF9oZWlnaHRfYnlfcGVyY2VudGFnZV9weF9tb2JpbGVcIjpcInBpeGVsc1wiLFwicGJfbWluX2hlaWdodFwiOlwiXCIsXCJwYl9mb250X3NpemVcIjoxMyxcInBiX2ZvbnRfc2l6ZV9mb3JfbW9iaWxlXCI6MTMsXCJwYl90aXRsZV90ZXh0X3NoYWRvd1wiOlwicmdiYSgyNTUsMjU1LDI1NSwwKVwiLFwiZW5hYmxlX3BiX3RpdGxlX3RleHRfc2hhZG93XCI6XCJvZmZcIixcInBiX3RpdGxlX3RleHRfc2hhZG93X3hfb2Zmc2V0XCI6MixcInBiX3RpdGxlX3RleHRfc2hhZG93X3lfb2Zmc2V0XCI6MixcInBiX3RpdGxlX3RleHRfc2hhZG93X3pfb2Zmc2V0XCI6MCxcInBiX3RpdGxlX3RleHRfc2hhZG93X21vYmlsZVwiOlwicmdiYSgyNTUsMjU1LDI1NSwwKVwiLFwiZW5hYmxlX3BiX3RpdGxlX3RleHRfc2hhZG93X21vYmlsZVwiOlwib2ZmXCIsXCJwYl90aXRsZV90ZXh0X3NoYWRvd194X29mZnNldF9tb2JpbGVcIjoyLFwicGJfdGl0bGVfdGV4dF9zaGFkb3dfeV9vZmZzZXRfbW9iaWxlXCI6MixcInBiX3RpdGxlX3RleHRfc2hhZG93X3pfb2Zmc2V0X21vYmlsZVwiOjAsXCJjcmVhdGVfZGF0ZVwiOlwiMjAyNC0wNC0xNyAyMDoyOTo1NlwiLFwiY3JlYXRlX2F1dGhvclwiOjMsXCJhdXRob3JcIjpcIntcXFwiaWRcXFwiOlxcXCIzXFxcIixcXFwibmFtZVxcXCI6XFxcIkRyLiBZb2dlbmRyYSBEZXN3YXJcXFwifVwiLFwiZW5hYmxlX2Rpc21pc3NcIjpcIm9mZlwiLFwiZW5hYmxlX2Rpc21pc3NfdGV4dFwiOlwiRGlzbWlzcyBhZFwiLFwiZW5hYmxlX2Rpc21pc3NfbW9iaWxlXCI6XCJvZmZcIixcImVuYWJsZV9kaXNtaXNzX3RleHRfbW9iaWxlXCI6XCJEaXNtaXNzIGFkXCIsXCJlbmFibGVfYm94X3NoYWRvd1wiOlwib2ZmXCIsXCJlbmFibGVfYm94X3NoYWRvd19tb2JpbGVcIjpcIm9mZlwiLFwiYm94X3NoYWRvd19jb2xvclwiOlwiIzAwMFwiLFwiYm94X3NoYWRvd19jb2xvcl9tb2JpbGVcIjpcIiMwMDBcIixcInBiX2JveF9zaGFkb3dfeF9vZmZzZXRcIjowLFwicGJfYm94X3NoYWRvd194X29mZnNldF9tb2JpbGVcIjowLFwicGJfYm94X3NoYWRvd195X29mZnNldFwiOjAsXCJwYl9ib3hfc2hhZG93X3lfb2Zmc2V0X21vYmlsZVwiOjAsXCJwYl9ib3hfc2hhZG93X3pfb2Zmc2V0XCI6MTUsXCJwYl9ib3hfc2hhZG93X3pfb2Zmc2V0X21vYmlsZVwiOjE1LFwiZGlzYWJsZV9zY3JvbGxfb25fcG9wdXBcIjpcIm9mZlwiLFwiZGlzYWJsZV9zY3JvbGxfb25fcG9wdXBfbW9iaWxlXCI6XCJvZmZcIixcInNob3dfc2Nyb2xsYmFyXCI6XCJvZmZcIixcImhpZGVfb25fcGNcIjpcIm9mZlwiLFwiaGlkZV9vbl90YWJsZXRzXCI6XCJvZmZcIixcInBiX2JnX2ltYWdlX2RpcmVjdGlvbl9vbl9tb2JpbGVcIjpcIm9uXCIsXCJjbG9zZV9idXR0b25fY29sb3JcIjpcIiMwMDAwMDBcIixcImNsb3NlX2J1dHRvbl9ob3Zlcl9jb2xvclwiOlwiIzAwMDAwMFwiLFwiYmx1cmVkX292ZXJsYXlcIjpcIm9mZlwiLFwiYmx1cmVkX292ZXJsYXlfbW9iaWxlXCI6XCJvZmZcIixcInBiX2F1dG9jbG9zZV9tb2JpbGVcIjpcIjBcIixcImVuYWJsZV9hdXRvY2xvc2VfZGVsYXlfdGV4dF9tb2JpbGVcIjpcIm9mZlwiLFwiZW5hYmxlX292ZXJsYXlfdGV4dF9tb2JpbGVcIjpcIm9mZlwiLFwib3ZlcmxheV9tb2JpbGVfb3BhY2l0eVwiOlwiMC41XCIsXCJzaG93X3BvcHVwX3RpdGxlX21vYmlsZVwiOlwiT2ZmXCIsXCJzaG93X3BvcHVwX2Rlc2NfbW9iaWxlXCI6XCJPZmZcIixcImVuYWJsZV9hbmltYXRlX2luX21vYmlsZVwiOlwib2ZmXCIsXCJhbmltYXRlX2luX21vYmlsZVwiOlwiZmFkZUluXCIsXCJlbmFibGVfYW5pbWF0ZV9vdXRfbW9iaWxlXCI6XCJvZmZcIixcImFuaW1hdGVfb3V0X21vYmlsZVwiOlwiZmFkZU91dFwiLFwiZW5hYmxlX2Rpc3BsYXlfY29udGVudF9tb2JpbGVcIjpcIm9mZlwiLFwiZW5hYmxlX2JnY29sb3JfbW9iaWxlXCI6XCJvZmZcIixcImJnY29sb3JfbW9iaWxlXCI6XCIjZmZmZmZmXCIsXCJlbmFibGVfYmdfaW1hZ2VfbW9iaWxlXCI6XCJvZmZcIixcImJnX2ltYWdlX21vYmlsZVwiOlwiXCIsXCJlbmFibGVfYm9yZGVyY29sb3JfbW9iaWxlXCI6XCJvZmZcIixcImJvcmRlcmNvbG9yX21vYmlsZVwiOlwiI2ZmZmZmZlwiLFwiZW5hYmxlX2JvcmRlcnNpemVfbW9iaWxlXCI6XCJvZmZcIixcImJvcmRlcnNpemVfbW9iaWxlXCI6XCIxXCIsXCJlbmFibGVfYm9yZGVyX3JhZGl1c19tb2JpbGVcIjpcIm9mZlwiLFwiYm9yZGVyX3JhZGl1c19tb2JpbGVcIjpcIjRcIn0iLCJzaG93X3BvcHVwX3RpdGxlX21vYmlsZSI6Ik9mZiIsInNob3dfcG9wdXBfZGVzY19tb2JpbGUiOiJPZmYifX0=";

!function(){const e=document.createElement("script");e.async=!0,e.setAttribute("crossorigin","anonymous"),e.src="//pagead2.googlesyndication.com/pagead/js/adsbygoogle.js?client=ca-pub-9548258067481809";let t=0;document.addEventListener("mousemove",function(){1==++t&&document.getElementsByTagName("HEAD").item(0).appendChild(e)}),window.onscroll=function(n){1==++t&&document.getElementsByTagName("HEAD").item(0).appendChild(e)},setTimeout(function(){0===t&&(t++,document.getElementsByTagName("HEAD").item(0).appendChild(e))},5e3)}();

https://www.uniquenewsonline.com/wp-content/plugins/theia-sticky-sidebar/js/ResizeSensor.js

https://www.uniquenewsonline.com/wp-content/plugins/theia-sticky-sidebar/js/theia-sticky-sidebar.js

https://www.uniquenewsonline.com/wp-content/plugins/theia-sticky-sidebar/js/main.js

https://www.uniquenewsonline.com/wp-content/themes/zox-news/js/mvpcustom.js

jQuery(document).ready(function($) {

var leaderHeight = $("#mvp-leader-wrap").outerHeight();

var navHeight = $("#mvp-main-head-wrap").outerHeight();

var headerHeight = navHeight + leaderHeight;

var previousScroll = 0;

$(window).scroll(function(event){

var scroll = $(this).scrollTop();

if ( typeof leaderHeight !== "undefined" ) {

if ($(window).scrollTop() > headerHeight){

$("#mvp-main-nav-small").addClass("mvp-nav-small-fixed");

$("#mvp-main-body-wrap").css("margin-top", navHeight );

} else {

$("#mvp-main-nav-small").removeClass("mvp-nav-small-fixed");

$("#mvp-main-body-wrap").css("margin-top","0");

}

if ($(window).scrollTop() > headerHeight + 50){

$("#mvp-main-nav-small").addClass("mvp-fixed");

$("#mvp-main-nav-small").addClass("mvp-fixed-shadow");

$(".mvp-fly-top").addClass("mvp-to-top");

if(scroll < previousScroll) {

$("#mvp-main-nav-small").removeClass("mvp-soc-mob-up");

$("#mvp-soc-mob-wrap").removeClass("mvp-soc-mob-up");

$(".mvp-drop-nav-title").removeClass("mvp-nav-small-post");

$(".mvp-nav-menu").show();

} else {

$("#mvp-main-nav-small").addClass("mvp-soc-mob-up");

$("#mvp-soc-mob-wrap").addClass("mvp-soc-mob-up");

$(".mvp-drop-nav-title").addClass("mvp-nav-small-post");

$(".mvp-nav-menu").hide();

}

} else {

$("#mvp-main-nav-small").removeClass("mvp-fixed");

$("#mvp-main-nav-small").removeClass("mvp-fixed-shadow");

$(".mvp-fly-top").removeClass("mvp-to-top");

}

} else {

if ($(window).scrollTop() > navHeight){

$("#mvp-main-nav-small").addClass("mvp-nav-small-fixed");

$("#mvp-main-body-wrap").css("margin-top", navHeight );

} else {

$("#mvp-main-nav-small").removeClass("mvp-nav-small-fixed");

$("#mvp-main-body-wrap").css("margin-top","0");

}

if ($(window).scrollTop() > navHeight + 50){

$("#mvp-main-nav-small").addClass("mvp-fixed");

$("#mvp-main-nav-small").addClass("mvp-fixed-shadow");

$(".mvp-fly-top").addClass("mvp-to-top");

if(scroll < previousScroll) {

$("#mvp-main-nav-small").removeClass("mvp-soc-mob-up");

$("#mvp-soc-mob-wrap").removeClass("mvp-soc-mob-up");

$(".mvp-drop-nav-title").removeClass("mvp-nav-small-post");

$(".mvp-nav-menu").show();

} else {

$("#mvp-main-nav-small").addClass("mvp-soc-mob-up");

$("#mvp-soc-mob-wrap").addClass("mvp-soc-mob-up");

$(".mvp-drop-nav-title").addClass("mvp-nav-small-post");

$(".mvp-nav-menu").hide();

}

} else {

$("#mvp-main-nav-small").removeClass("mvp-fixed");

$("#mvp-main-nav-small").removeClass("mvp-fixed-shadow");

$(".mvp-fly-top").removeClass("mvp-to-top");

}

}

previousScroll = scroll;

});

});jQuery(document).ready(function($) {

// Video Post Scroll

$(window).on("scroll.video", function(event){

var scrollTop = $(window).scrollTop();

var elementOffset = $("#mvp-content-wrap").offset().top;

var distance = (elementOffset - scrollTop);

var aboveHeight = $("#mvp-video-embed-wrap").outerHeight();

if ($(window).scrollTop() > distance + aboveHeight + screen.height){

$("#mvp-video-embed-cont").addClass("mvp-vid-fixed");

$("#mvp-video-embed-wrap").addClass("mvp-vid-height");

$(".mvp-video-close").show();

} else {

$("#mvp-video-embed-cont").removeClass("mvp-vid-fixed");

$("#mvp-video-embed-wrap").removeClass("mvp-vid-height");

$(".mvp-video-close").hide();

}

});$(".mvp-video-close").on("click", function(){

$("#mvp-video-embed-cont").removeClass("mvp-vid-fixed");

$("#mvp-video-embed-wrap").removeClass("mvp-vid-height");

$(".mvp-video-close").hide();

$(window).off("scroll.video");

});});jQuery(document).ready(function($) {

// Mobile Social Buttons More

$(".mvp-soc-mob-right").on("click", function(){

$("#mvp-soc-mob-wrap").toggleClass("mvp-soc-mob-more");

});

});jQuery(document).ready(function($) {

$(".menu-item-has-children a").click(function(event){

event.stopPropagation();});$(".menu-item-has-children").click(function(){

$(this).addClass("toggled");

if($(".menu-item-has-children").hasClass("toggled"))

{

$(this).children("ul").toggle();

$(".mvp-fly-nav-menu").getNiceScroll().resize();

}

$(this).toggleClass("tog-minus");

return false;

});// Main Menu Scroll

$(".mvp-fly-nav-menu").niceScroll({cursorcolor:"#888",cursorwidth: 7,cursorborder: 0,zindex:999999});

});

https://www.uniquenewsonline.com/wp-content/themes/zox-news/js/scripts.js

https://www.uniquenewsonline.com/wp-content/themes/zox-news/js/retina.js

https://www.uniquenewsonline.com/wp-content/themes/zox-news/js/flexslider.js

https://www.uniquenewsonline.com/wp-includes/js/comment-reply.min.js

(function(w,d, s, id) {w.webpushr=w.webpushr||function(){(w.webpushr.q=w.webpushr.q||[]).push(arguments)};var js, fjs = d.getElementsByTagName(s)[0];js = d.createElement(s); js.async=1; js.id = id;js.src = "https://cdn.webpushr.com/app.min.js";

d.body.appendChild(js);}(window,document, 'script', 'webpushr-jssdk'));

webpushr('setup',{'key':'BPjbvHzuEYRqFV4yiEu3fIxgQ_hu6jxsQjNdj6baiXPpbFathx1pQk1KL7M1lXEoliGJckK0dG6UeYUZuTIiCRQ','sw':'https://www.uniquenewsonline.com/wp-content/plugins/webpushr-web-push-notifications/sdk_files/webpushr-sw.js.php'});

window.lazyLoadOptions = {

elements_selector: "iframe[data-lazy-src]",

data_src: "lazy-src",

data_srcset: "lazy-srcset",

data_sizes: "lazy-sizes",

class_loading: "lazyloading",

class_loaded: "lazyloaded",

threshold: 300,

callback_loaded: function(element) {

if ( element.tagName === "IFRAME" && element.dataset.rocketLazyload == "fitvidscompatible" ) {

if (element.classList.contains("lazyloaded") ) {

if (typeof window.jQuery != "undefined") {

if (jQuery.fn.fitVids) {

jQuery(element).parent().fitVids();

}

}

}

}

}};

window.addEventListener('LazyLoad::Initialized', function (e) {

var lazyLoadInstance = e.detail.instance;if (window.MutationObserver) {

var observer = new MutationObserver(function(mutations) {

var image_count = 0;

var iframe_count = 0;

var rocketlazy_count = 0;mutations.forEach(function(mutation) {

for (i = 0; i < mutation.addedNodes.length; i++) {

if (typeof mutation.addedNodes[i].getElementsByTagName !== 'function') {

return;

}if (typeof mutation.addedNodes[i].getElementsByClassName !== 'function') {

return;

}images = mutation.addedNodes[i].getElementsByTagName('img');

is_image = mutation.addedNodes[i].tagName == "IMG";

iframes = mutation.addedNodes[i].getElementsByTagName('iframe');

is_iframe = mutation.addedNodes[i].tagName == "IFRAME";

rocket_lazy = mutation.addedNodes[i].getElementsByClassName('rocket-lazyload');image_count += images.length;

iframe_count += iframes.length;

rocketlazy_count += rocket_lazy.length;if(is_image){

image_count += 1;

}if(is_iframe){

iframe_count += 1;

}

}

} );if(image_count > 0 || iframe_count > 0 || rocketlazy_count > 0){

lazyLoadInstance.update();

}

} );var b = document.getElementsByTagName("body")[0];

var config = { childList: true, subtree: true };observer.observe(b, config);

}

}, false);

https://www.uniquenewsonline.com/wp-content/plugins/rocket-lazy-load/assets/js/16.1/lazyload.min.js

Viral1 week ago

Viral1 week ago

Viral4 days ago

Viral4 days ago

Viral1 week ago

Viral1 week ago

Viral5 days ago

Viral5 days ago

Viral4 days ago

Viral4 days ago

Net Worth5 days ago

Net Worth5 days ago

Viral4 days ago

Viral4 days ago

Viral1 week ago

Viral1 week ago